Retiring is an important lifetime decision. But what is going to happen if bear market is in a full steam and the plan is to live on investment income? Potentially, Social Security can help but it may be many years ahead and it may take even longer than anticipated as the retirement age may increase in future? In this article, I try to bring together some ideas how to prepare to such a difficult situation.

Fortunately, there are different types of investment, in order of their safety:

- US treasuries: guaranteed by government, therefore the most stable asset.

- Certificate of deposit (CD): FDIC insured and call protected, guaranteed by the bank with federal insurance support. No growth but no risk to principal and stable interest.

- Bonds: interest is safe as long as the borrowing institution is in business. But share price does not grow much even in a bull market.

- Equities paying dividend: reasonably stable but may be cut or eliminated at any time. But there are companies – aristocrats which are growing dividend for many decades.

- Growth equities: highly volatile, especially under bear market. But in a bull market, share price may experience a substantial growth.

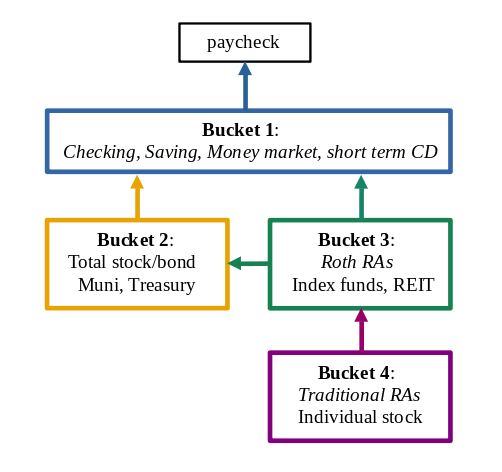

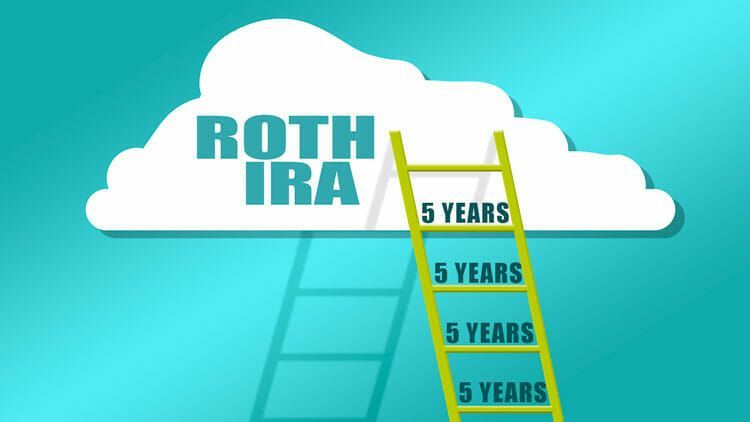

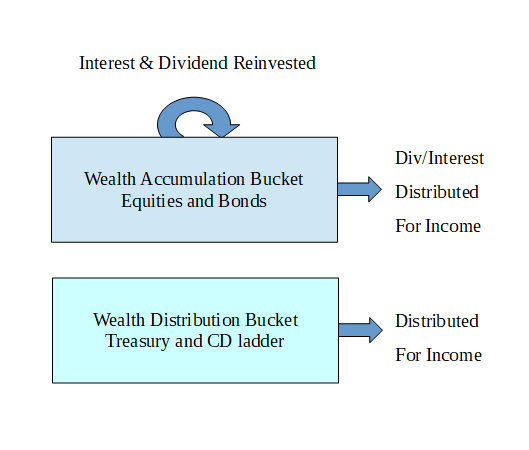

In earlier article, buckets approach has been discussed. Indeed, it can be a great approach to retirement safety if implemented correctly. For simplicity, we can consider just two buckets: the first one to provide a stable income for living, and the second one to continue wealth accumulation. The fixed income bucket may include CD or treasury ladder, built for the next 5-10 years. The ladder is important to protect income from inflation. Right now through 2023, there are great opportunities to set it up because the rates are historically high. The accumulation bucket may include bonds and equities with interest or dividends reinvested into the same securities. Also, there can be a mix of two for example some part of dividends from accumulation bucket withdrawn for income.

The bucket approach described above is missing one principal part: what happens to the total investment balance. Most people would prefer to keep it growing, or not shrinking at least. How is it possible in bear market condition? May be not in a short term, but it can be achieved in a long term because historically after the bear market there is always a bull market. However it also depends on the type of investments being used in accumulation bucket. How to estimate and plan it well ahead of future market situation?

Let us assume we have X1 funds in accumulation bucket which are growing at Y1 interest or dividend rate. Then the annual income would be X1 * Y1. In distribution bucket, we have X2 funds growing at Y2 interest rate. The difference is that along with interest, we want to withdraw a part of principal proportional to the number of years N we want this bucket to last. The annual distribution would be X2 * Y2 + X2 / N. We want the annual distribution from accumulation bucket to be always greater than annual distribution from fixed income bucket: X1 * Y1 > X2 * ( Y2 + 1/N ).

In the formula above, it would be interesting to see the ratio between the funds in accumulation and distribution buckets, with respect to the number of years and interest (dividend) rate: X1 / X2 > ( Y2 / Y1 + 1/( N * Y1 ) ) . Taking 5% rate and 5 years as a reference for both buckets, the ratio must be greater than 5 to meet the criteria. Assuming we would need at least $40K annually or around $200K for five years to live, more than $1M would be required to have in accumulation bucket. But in a reality we may need more than $40K per year for living, and we may not have another $1M to invest. What do we do? The good news is that the above estimation is quite pessimistic.

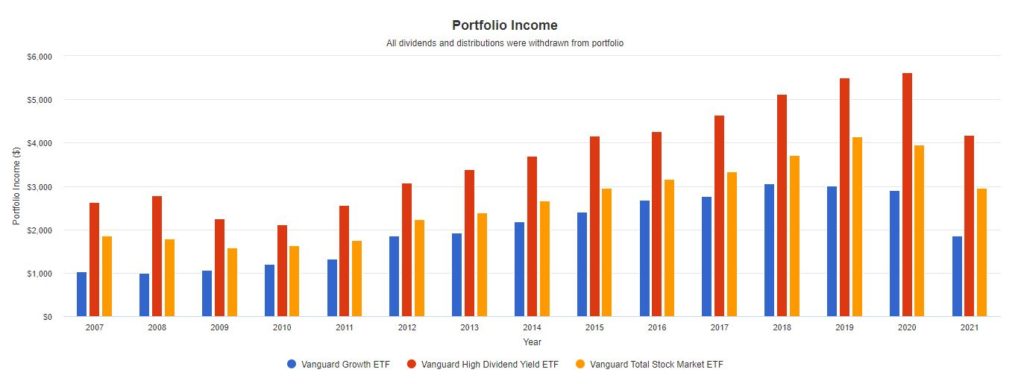

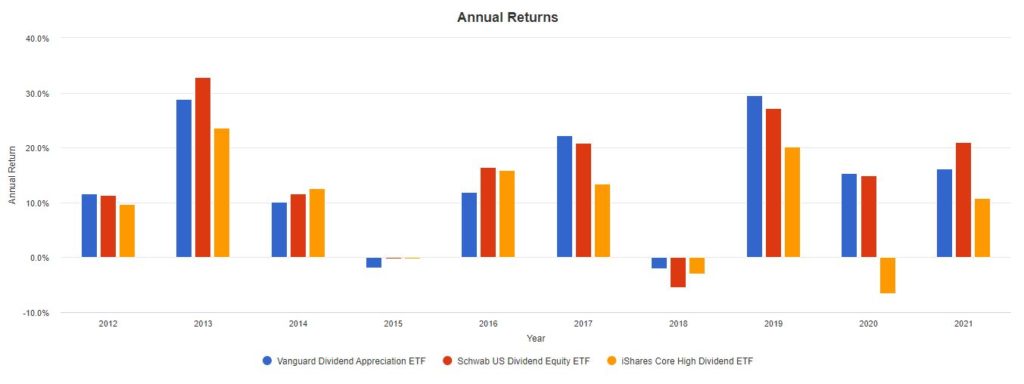

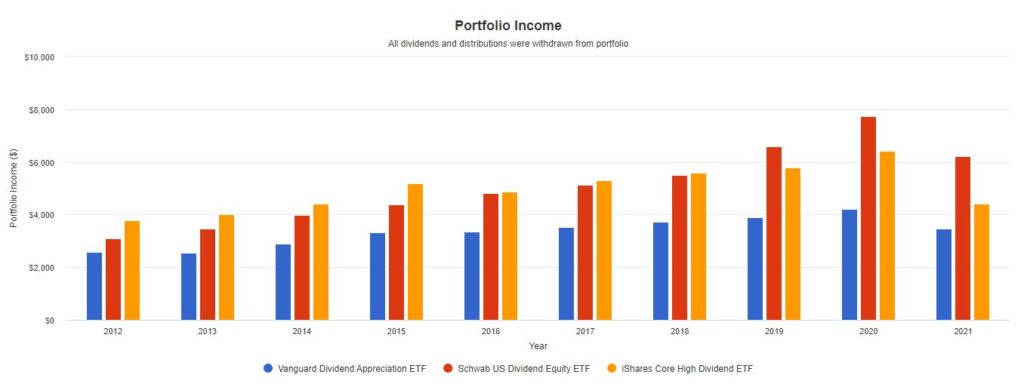

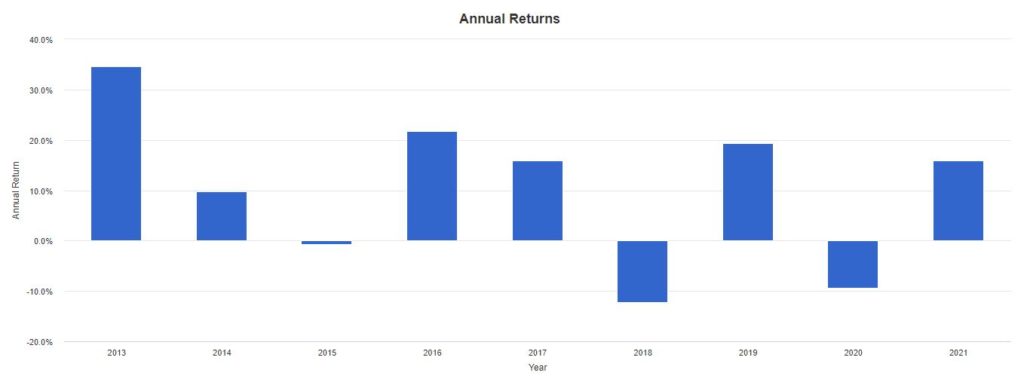

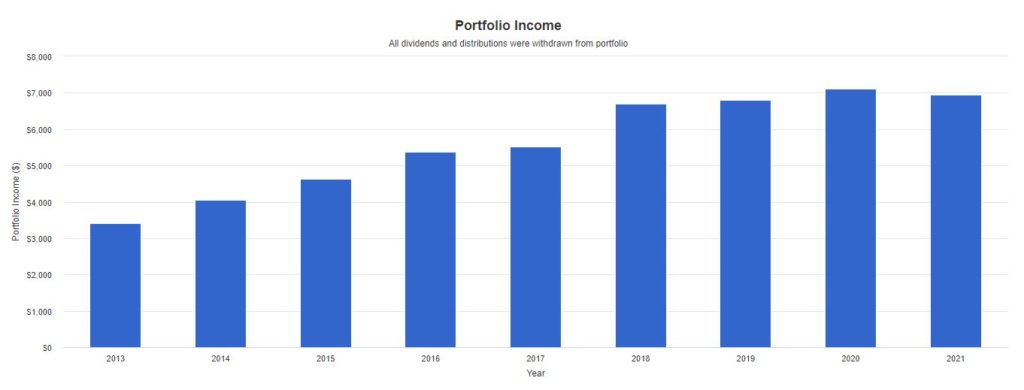

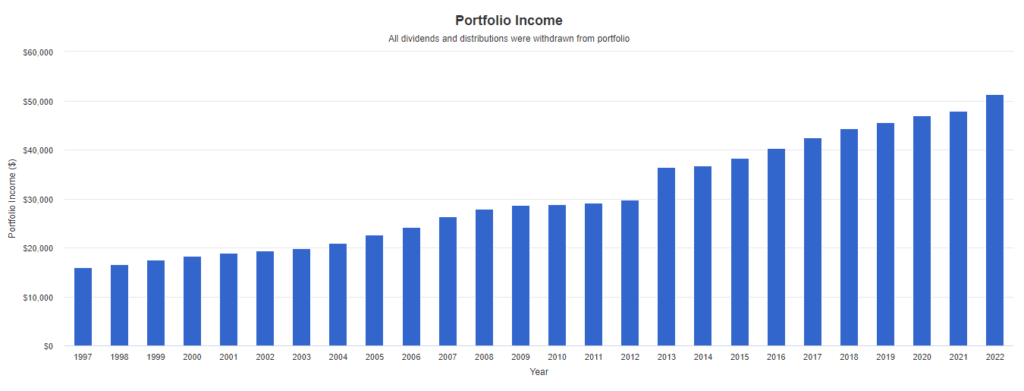

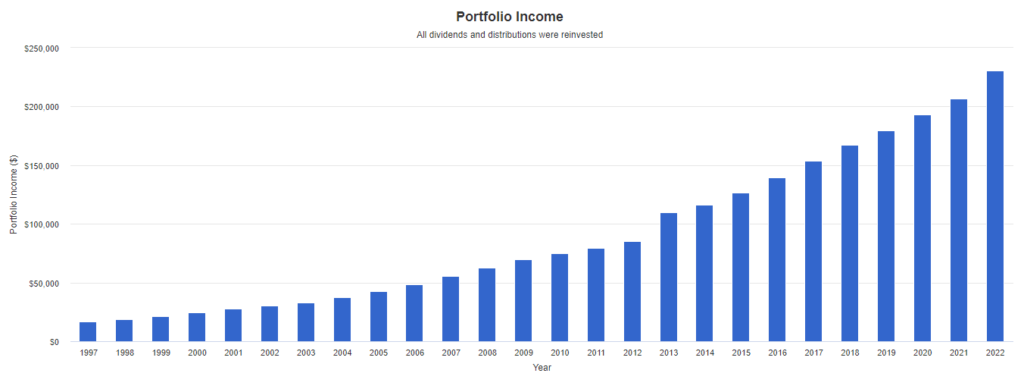

With some effort we can raise the investment rate in accumulation bucket to 8-10%. There are some investments with return beyond 10%, but they need to be analyzed carefully as higher risk investments. But even with 8% rate, the X1 / X2 ratio drops from 5 to 3.125 which means just $625K is required to secure the annual income $40K from fixed income bucket for five years. However even more important observation is that we are missing the power of reinvestment. The formula provided works well for one year of income estimation. For the second, third year and beyond accumulation bucket would produce more income just because more shares will be added as a result of reinvestment. We can use Realty Income (O) annual distributions without and with dividend reinvestment over the last 25 years as an example (charts were produced by Portfolio Visualizer).

The other important side of reinvestment strategy is how well it works in a bear market. This is because every time the equity decline in price there is an opportunity to buy more shares for a lower price. And finally we end up with even more interest or dividend coming out. For example, AAPL with share price $174 pay dividend $0.96 per share. We can buy 5 shares with dividend $4.8 paid annually. But with share price dropped to $160, additional 0.03 shares will be reinvested rather than 0.028 with initial share price. Though it is still important to choose investments which did not reduce dividends or eliminated them entirely in past bear markets. Besides that, it is worth to mention that fixed income bucket produces the stable income regardless of market conditions. This is why the discussed two buckets strategy would perform well in a bear market when combined together.

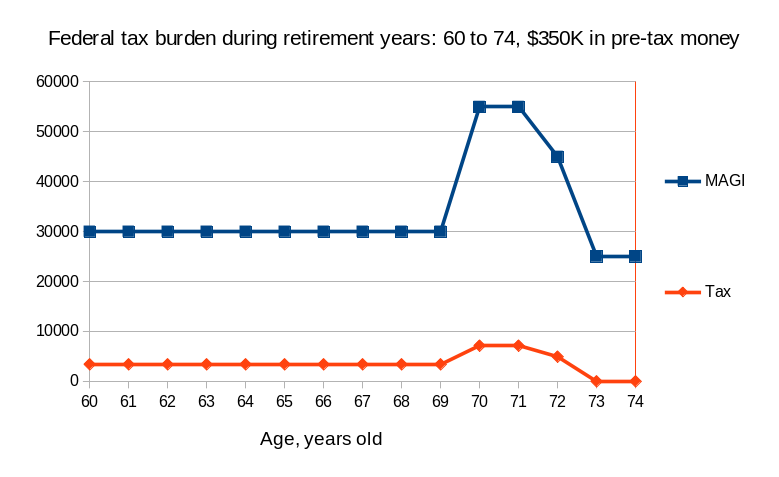

But what about the time line? Do we want to change the buckets, when more years are spent into retirement? It appears the fixed income bucket is more important for earlier retirement years, because of the retirement date selected on the edge of bear market and the following Sequence Of Return Risk (SORR). The fixed part can be gradually replaced with Social Security and pension later into retirement. There was a great article by Kitces explaining how fixed income part can help to navigate the retirement “red” zone with extreme portfolio size volatility in early years.

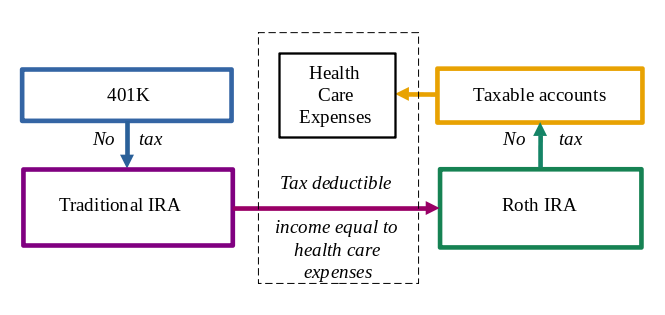

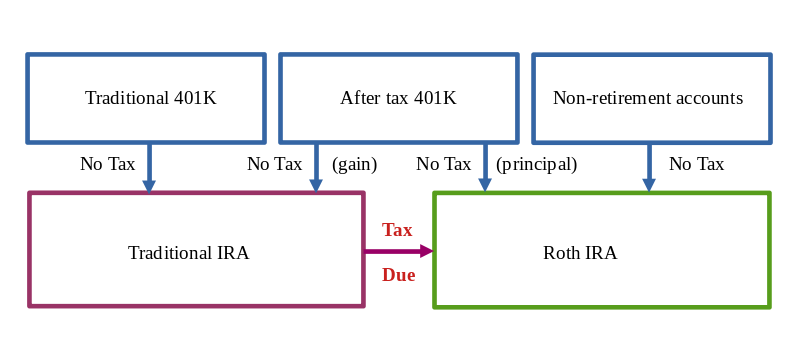

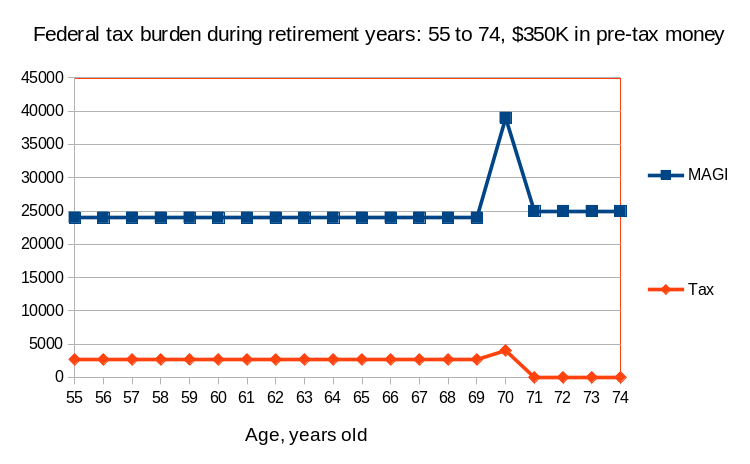

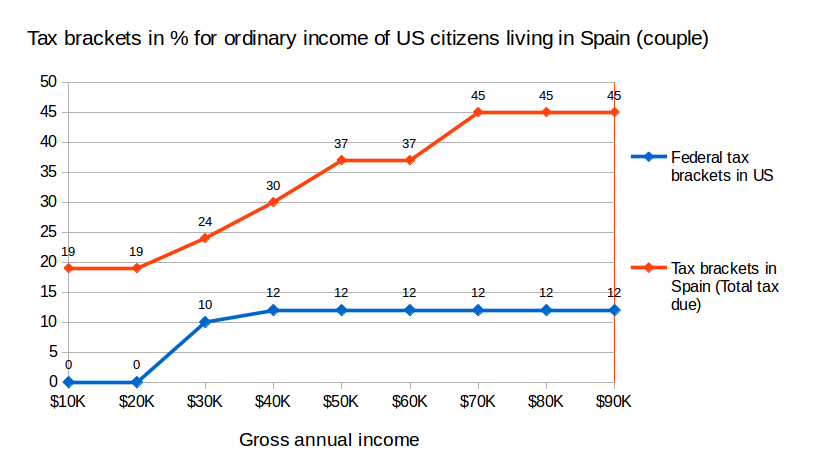

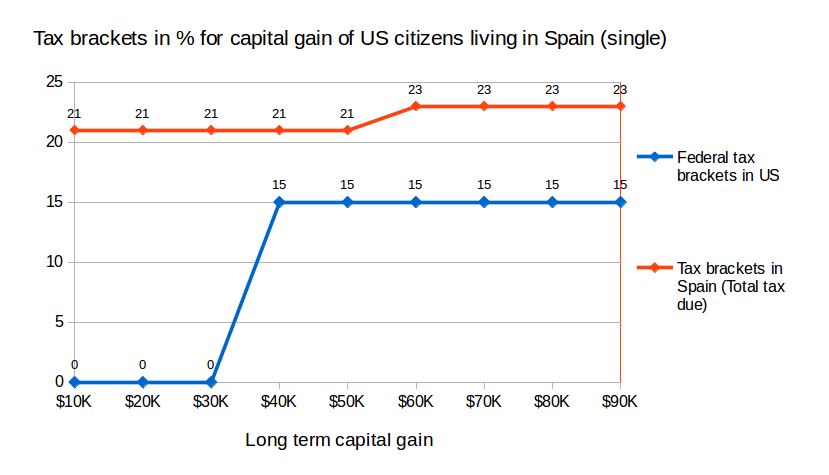

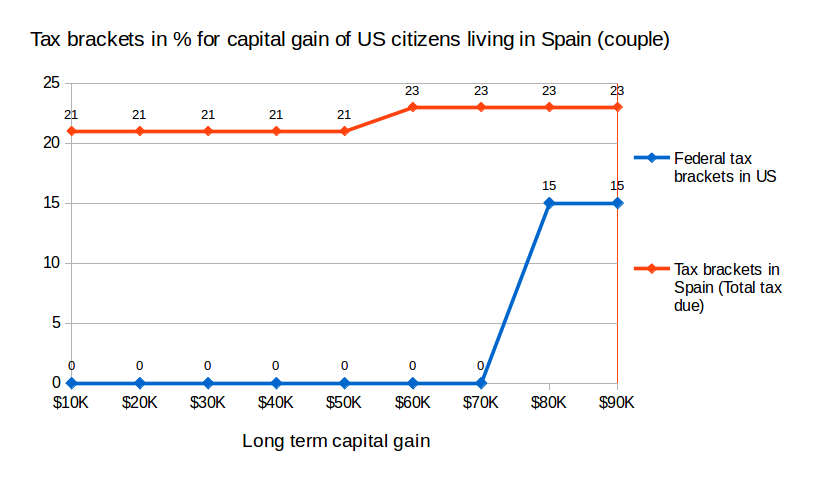

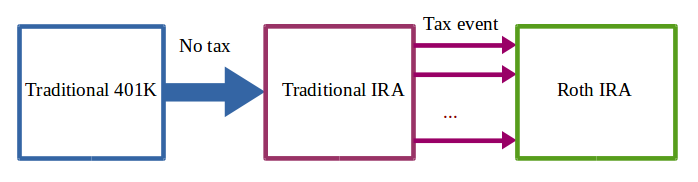

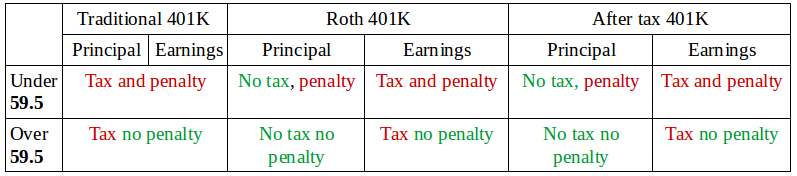

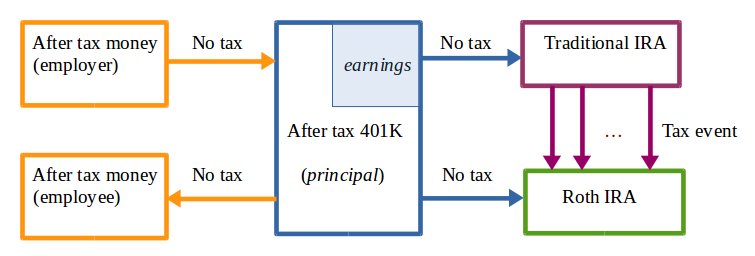

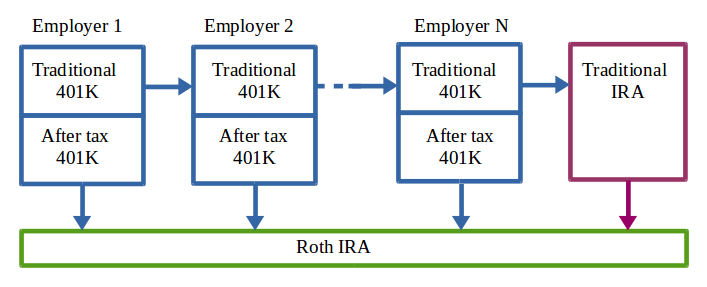

Finally, a few words about the tax consideration. It is beneficial to have a fixed income bucket funded with taxable accounts, while it is more natural for accumulation bucket funds to come from retirement accounts as these funds will be used later. It would help to reduce the taxable income in early years, because of after tax money primarily used (with small addition of interest from CD or treasury ladder). Also it would help to reduce the total income in later years, because the taxable part has been already spent and most accumulation bucket funds would come from Roth IRA providing a tax-free income for life.

As a summary, these are the important actions for everyone to consider, to ensure safe retirement income in a bear market:

- set up two buckets, one for wealth accumulation and another one to produce fixed income (wealth distribution)

- fund the buckets properly, to make sure the total income keep growing or at least remain the same with the required distributions

- use income bucket distributions for living, with potential mix of some dividends or interest from accumulation bucket

- gradually replace fixed income bucket with pension and Social Security according to the plan

- first years into retirement are the most important due to market condition on retirement date and SORR

- allocate wealth accumulation bucket primarily for retirement accounts, while fixed income (wealth distribution) bucket for taxable accounts.