Investment is an extremely popular topic discussed by many bloggers. It is vitally important to manage financial assets efficiently, since any mistake is terribly expensive and may eventually lead to complete loss of money, loss of home and pretty much everything we have in our lives. In this article, I wanted to share my opinion based on the decades of experience I have managing personal investments for employer sponsored 401K plan. We will discuss different types of investment and how to combine them, to earn money and avoid poverty.

Stock is an ownership interest in corporation, which actually issue that stock. Individual investor can buy a stock of any public company, traded on the financial market. Stock has always been considered as a risky investment: it may cause a significant loss of money, as it tend to drop by various reasons. Even large corporations are not protected: for example, Bank of America’s stock (BAC) lost almost 100% of its value in 2009 during the recent recession, locked in a slow and painful recovery since that time. But lately, stock market gains were very impressive. Also, some companies pay dividends to their shareholder, which add a value to the stock. Therefore, it is better to buy stock market funds, rather than individual company’s stock. Total US stock market funds (such as VTI or VSAX) obviously experienced more than 50% drop during the economy downturns, but they never lost 100% of the value and always recovered in a few years. But it is not exactly applicable to international stock market funds like VEU or VXUS: this type of investment is difficult to manage, the fund may lose more than 50% of its value and historically does not yield performance similar to US stock market. Still, it can be a part of portfolio in order to mitigate risks associated with US market. It is attractive to own stock funds, if you are looking for 5-6 years term investment: during that time, the stock will likely recover even in the worst scenario. Typically, it is advised to have about 60% of the total assets in stock funds when you are younger than 35 and to bring stock portfolio down to 30% by retirement age.

By purchasing a bond, you lend a specific amount of money to the issuer of that bond. In return to your money, issuer will pay an interest to maturity and in addition to that will return a bond value by specific date. Bonds can be issued by corporations or government agencies. There are bond funds available on the marker, such as BND which hold primarily US Treasury and corporate bonds, IEI with a focus on US Treasury bonds only, and MUB managing various municipal bonds. The aggregate bond funds such as AGG for example, combine multiple types of bonds. Bonds are a safer investment as they never drop by 50% as stock do. But the return is low. Still, bonds can be an important part of conservative portfolio. It is typically advised to hold from 20% to 40% of the total assets in bonds. TIPS are also bonds, but considered as a different type of investment with even less risk than bonds, because they hold US Treasury issued inflation protected securities. The US Treasury notes has a fixed return, combined with a variable rate adjusted with the inflation. Lately, the variable part was almost non-existent because of the historically low interest rate. But it is changing now. To protect the portfolio from rapid changes in market conditions, it is better to include 10% to 20% of the TIP into the diversified portfolio.

The other type of investment is Real Estate Investment Trust (REIT). The trust represents the company, which own income producing real estate. Similar to stock funds, there are domestic (VNQ) or international (VNQI) funds. In fact, they both are ETF i.e. Exchange Transfer Funds. ETF manage assets like an index fund, which means it is traded on stock exchange similar to stock. ETF has lower fees, compared to funds. But with respect to real estate, the performance is variable and the value can drop not as much as individual stock, which is still less than most stock funds. For example, VNQ experienced 75% loss in year 2009 during one of the worst real estate crisis in history. By contrast, VNQI is more stable but does not produce much return since real estate market recovery. For portfolio diversification purpose, it is recommended to have at least 10% assets in REIT.

The remaining type of investment are commodities. These are the most volatile and expensive investments, and because of that reason it is normally recommended to hold no more than 5% for younger generation of investors, and eliminate it as you get closer to the retirement. DBC is one of the well known commodity tracking funds. Currently, it appears as an attractive low price entry point. However, return may not be great at least in the nearest future, due to the strong dollar and striving economy in US. There are funds for certain types of commodity, such as gold shares GLD or silver trust SLV. They are relatively expensive to hold, though less expensive than DBC. In addition to commodities, it is worth to mention foreign currencies as another investment choice. Although even more volatile than commodities, currency trading may provide a safe heaven for the times when US dollar is loosing its strength. There is a popular digital or virtual currency Bitcoin. Recently, it was doing very well: the value jumped more than 100 times during the recent few years. Eventually, virtual currency may replace US dollar in all domestic monetary transactions.

In order to have a well balanced portfolio, it is important that each type of investment is included as discussed above (may be except for commodities and foreign currencies). But actually there is one excellent Vanguard fund which successfully manage the entire portfolio for you: VWINX. This fund has an exceptional track record (even during the latest downturn, it lost no more than 30% of its value) and diversified by holding both US domestic and foreign stocks, bonds and some other investments. There are other total market funds available from Fidelity or Schwab for example, but Vanguard has the lowest fees.

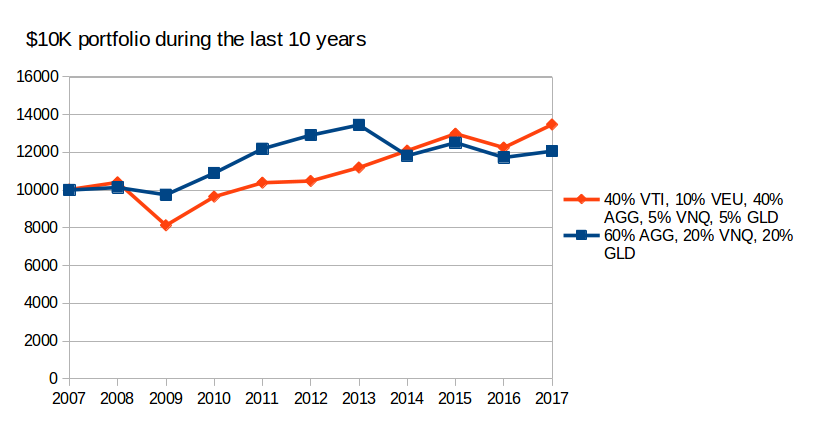

Let us consider the typical portfolio for mid-age investor, assuming $10K has been initially invested in year 2007: 40% US Stock (VTI), 10% foreign stock (VEU), 40% bond (AGG), 5% REIT (VNQ), 5% commodities (GLD). The graph to demonstrate a portfolio change during the last 10 years is shown below (red curve). Apparently, investor lost some money during the recession years. But then it nicely recovered, grown up to $13478 by the beginning of year 2017 (with the total return more than 25%). Then, let us consider another portfolio with domestic and foreign stock completely eliminated. The remaining investments include 60% bond (AGG), 20% REIT (VNQ) and 20% commodities (GLD). The blue curve on the graph associated with this portfolio clearly show that investor did not lose much during the recession, and had a return well above the traditional portfolio (red curve) up to year 2014. Solid stock gain made traditional portfolio superior after that time. Still, the portfolio without stock end up with 18% total return by the year 2017.

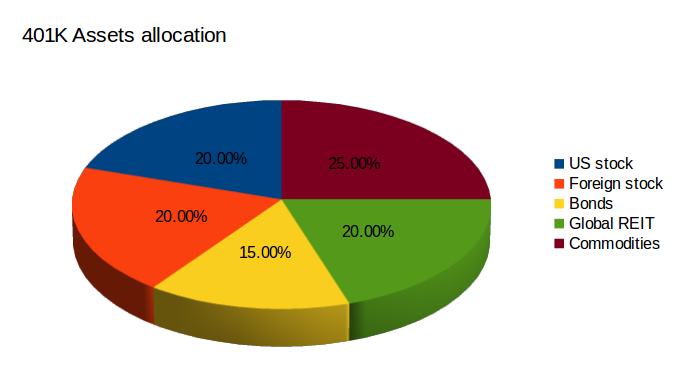

The graph clearly show that stock missing within the portfolio is likely to diminish the return on investment over the long term. But from other side, stocks tend to lose their value more than other types of investments during certain events like a recession. I typically prefer to stay with bonds, REIT and commodities within the portfolio, combined with some individual stocks rather than total market fund (like VTI). Another important consideration is the entry point: how much is the fund or stock value at the time, when initial investment is made. While it does not make much difference for bonds, the stock value relative to the previous time may give some guidance. But the history does not always repeat itself. During the last year, my portfolio included 20% individual US stock (BAC, C), 20% foreign stock (VTRIX, VWO), 15% bond (BND), 20% global REIT (VNQI, WPS) and 25% commodities (GLD, SLV).