When to apply for social security benefits? Many people are interested to learn. It is well known, that anyone with earned income during at least 10 years can apply for this well deserved help from the federal government at the age of 62 or later. Late application is always welcome: the amount is growing with applicant’s age, with maximum reached by the time applicant turns 70 years old. This is the way how government encourage us to apply later, rather than earlier.

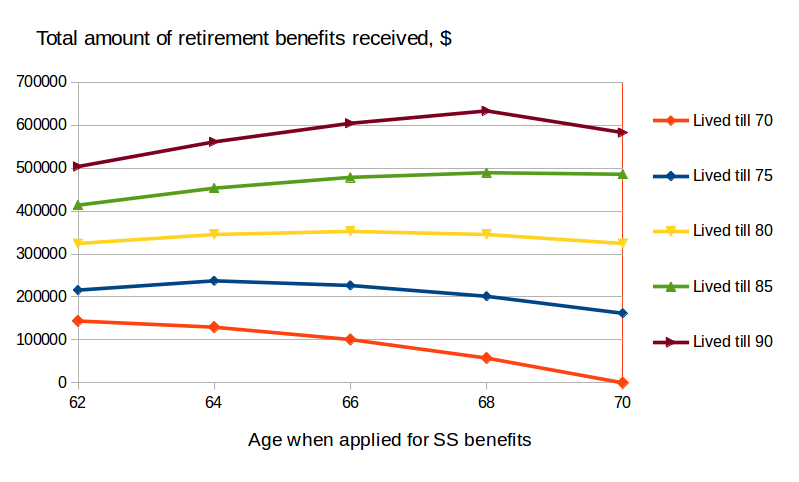

In 2016, I wrote an article with some calculations how both retirement age and application age affect the benefit. For example, someone with 18 years of professional career behind may be looking for $1,500 when applied at 62 or $2,700 when applied at 70. Let us use this example to determine, if indeed it is better to delay application as much as possible or not? The graph below is created in assumption that applicant stopped working before 62. It reports the total amount of benefit collected over the retirement time using the above example, defined by the application age and end-of-life age.

From the picture, we can clearly see that the total amount depends on the end of life age. It may be hard to predict, but for an average person 80 to 85 years would be a reasonable bet. But an important observation is that actually the total amount show a little difference with application age for those passed away at 80. And even for those lived till 85, applying at 66 rather than 70 seems a pretty good choice because the amount does not change much later. Obviously early application helps greatly to those passed away at 70 or 75. You can substitute your benefit numbers, but the trend will look roughly the same: delaying application may not bring as much money, as anticipated.

There is yet another aspect for this analysis. Those applied early for the benefit, may be able to invest and grow money saved due to the social security income. For example, $18K (which is equivalent to the benefit of $1,500 per month) invested with 4% return would yield $5,760 over 8 years. But even more important consideration is an income tax. Please do not forget, that social security benefit is a taxable income. However, as of now we have to make at least $25K per year as an individual (or $32K with joint return) in order to be liable for federal tax. Some states also tax social security: Colorado, Connecticut, New Mexico, Rhode Island, Kansas are among them. It may be well justified to apply early for social security to avoid the tax, by limiting retirement income to around $2K per month.

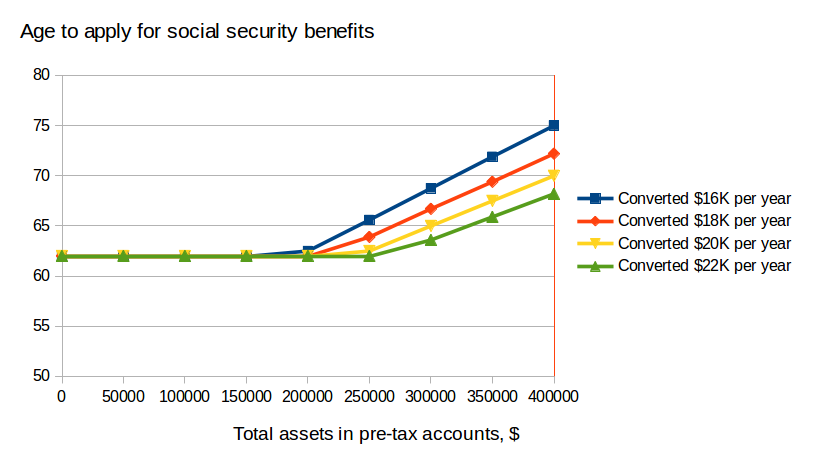

Finally, let’s not forget about 401K and other accounts where pretax money are collected. They designed to fund our golden retirement years, but may carry a significant tax burden. There is a great article written by Curry Cracker: is your 401K too big? Indeed, collecting large amount would eventually lead to higher tax and effectively reduced social security benefit. But what number is reasonable? It depends. Thanks to the recent tax reform, one can claim as much as $22K per year which includes $12K in standard deduction combined with $10K state and local income tax cap through 2025. It means, that converting up to $22K each year from 401K to Roth IRA would not trigger any federal tax (assuming there is no other taxable income). Based on this magic number and the age when conversion starts, it is easy to estimate if your 401K is too big or not.

Let us assume, that 50 years old person is considering to quit a job and make annual 401K conversions into Roth IRA to ensure the entire amount is converted into after tax money before applying for social security benefit. In this case, no federal tax paid either on 401K distributions, or social security income. As demonstrated by the graph, he or she is out of luck if total pretax assets are greater than $300K: even $22K distribution would lead to the delay in applying for social security benefit. Smaller distributions would further delay it, even beyond 70 in some cases. What is a solution? Save more after tax money over a shorter time and reduce a tax bracket as early as possible. Those of us, who does not have enough money to live and must remain in high tax bracket till 60, 65 or later should expect higher tax and reduction in social security benefit.

Therefore, decision when to apply for social security benefit is not that simple. Delay in application may sound right at the first, but in fact depends on multiple factors such as life expectation, the age when conversion starts, tax bracket and assets in pretax and after tax accounts.