Everyone know that stock market may be up and down, at different times. It is in a human nature to believe in magic and hope for infinite growth. But there are cycles around 8-10 years each, when bad times keep coming to investors. Is it possible to prepare for that time in advance? And may be, to have a chance to grow money while everyone else is loosing? No way: it is impossible to predict the future. But there is a history of previous events. What is a lucky combination of investments, which performed with minimal loss during recessions in the past? Let us to find it out, with focus on at least two last major market collapses in 2001 and 2009. Past performance does not guarantee the future, but may help to survive for a while.

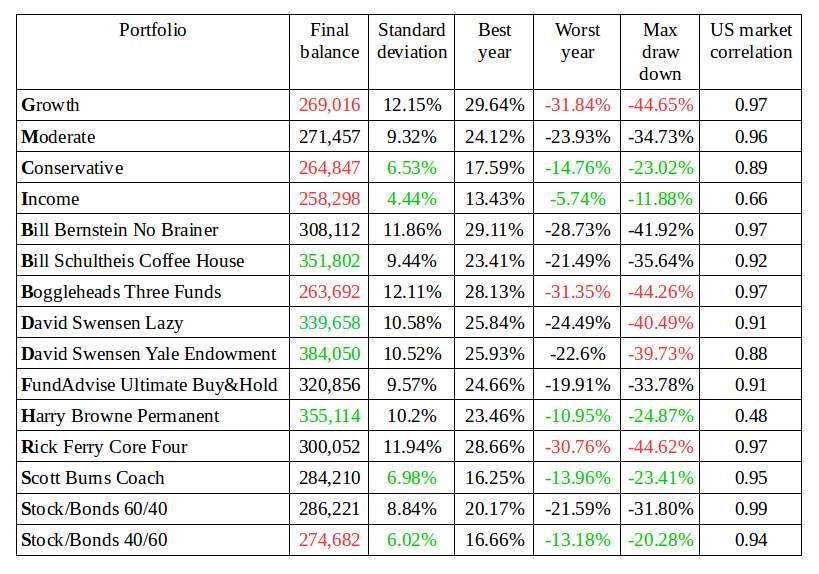

In order to do that, we need to see how different types of investments performed since year 2000. I found this online tool to be very useful to choose certain combination of investments and compare their performance over the years. There are so many ways to combine different funds or individual stocks/bonds: it may take the entire life to find the right solution. Fortunately, other people already taken care about it. As a result, we have famous portfolios to consider: growth, moderate, conservative, income, Bill Bernstein No Brainer, Bill Schultheis Coffee House, Boggleheads Three Funds, Boggleheads Four Funds, David Swensen Lazy, David Swensen Yale Endowment, FundAdvice Ultimate Buy and Hold, Harry Browne Permanent, Larry Swedroe Simple, Larry Swedroe Minimize FatTails, Mebane Faber Ivy, Rick Ferry Core Four, Scott Burns Couch, Stock/Bonds 60/40, Stock/Bonds 40/60. They all are called lazy portfolios, which mean they do not require much time to manage. Some funds are relatively new and made available after the year 2001 collapse or sometimes even after 2009. In order to have a fair comparison, I decided to replace some funds/ETF with similar funds which has inception data before year 2000: VIPSX with VFITX, TLT with VUSTX, EFV with EWQ (this one was hard to find, as emerging market ETF does not have a long history), VTI with FSTMX and GLD with TGLDX. The results based on key portfolio analysis since year 2000 for initial amount $100K and rebalance bands 5/25% (balance made when some funds are up 5% or down 25%) are in the table below.

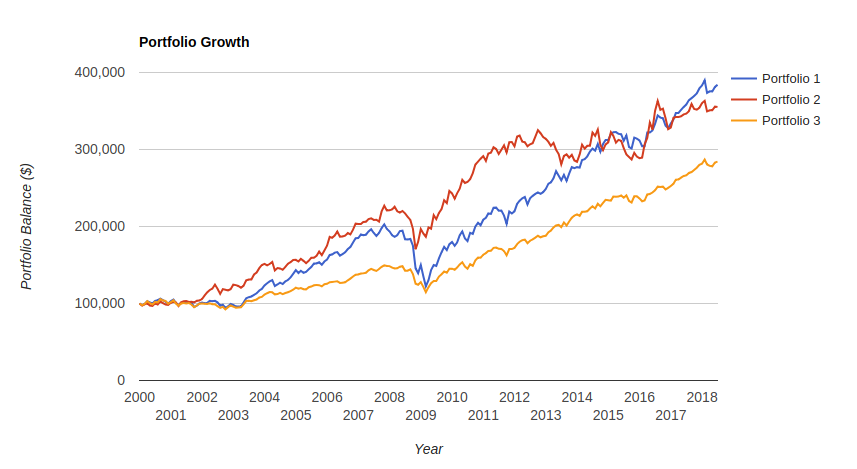

In the table, I selected higher final balance, lower standard deviation and lower draw down numbers in green. Opposite numbers are in red. As you can see, higher final balance almost always lead more volatility. For example, income portfolio has excellent standard deviation and minimum draw down, but final balance is the lowest one. However there are a few exceptions. After some considerations, I put together a chart with the following portfolios for detailed analysis: David Swensen Yale Endowment (blue line), Harry Browne Permanent (red line) and Scott Burns Coach (orange line). This graph does not tell much about year 2001 event, but year 2009 obviously affected all funds. Red line (Permanent Portfolio) clearly outperformed others over the time, except recent years when Blue line provide a better balance.

In order to understand the chart, more details about these investments are required. David Swensen Yale Endowment portfolio essentially focus on aggressive stock allocation (both total stock market and REIT market makes 50% of it) with developed and emerging markets making other 20%, and has remaining 30% invested in long and intermediate term treasuries. It explains why it had a deeper drop during the last recession. Harry Browne Permanent portfolio equally distribute money across total stock market, long term treasuries, gold and cash (25% each). Scott Burns Coach portfolio simply divides the entire amount between total market and long term treasuries 50/50. Apparently the large presence of treasuries with conservative yield makes it a money looser in a long run, although does not allow loosing during the recession as much as others. What would you choose among these three portfolios? I found Harry Browne Permanent portfolio the most appealing to investors looking for moderate yield without a significant risk to lose.

I found there were plenty of discussions about Permanent Portfolio in the past, including passionate debates at Boggleheads forums. This portfolio has been initially introduced by Harry Browne and use four basic categories distributed equally: prosperity (supported by stock market), inflation (supported by gold), deflation (supported by long term bonds), and recession (supported by cash). Indeed, having at least one category to strive theoretically prevents portfolio from large loss. Each category does not rely on particular fund on ETF. It rather relies on broader family of investments. For example Vanguard solution would include VTI, VGLT, GLD and VGSH, while Fidelity solution include FSTVX, FLBAX, GLD and FSBAX. It is also worth to mention, that Blackrock iShares ETF maintain permanent portfolio just in case someone want a complete solution.

The critics of Harry Browne Permanent portfolio often refer to the low stock market exposure which made it under performer during the great times for stock market, high exposure to gold which price is hard to predict, no international funds (which can be actually a good news right now when emerging markets are under increasing risk), using treasury bonds without a broader bond market exposure. It has been declining in popularity in recent years, however as it may perform better than others when tough times are ahead.

Thanks for your blog, nice to read. Do not stop.