It is a well-known fact, that many American citizens choose to live abroad because of different reasons: cost of living, family related, political preferences. Some people just want to discover the world on their spare time, or work for foreign employer. According to the official sources, over 8 million non-military Americans are living outside US. There are plenty of useful Internet resources for expats, with focus on various aspects of life. We already explored tax challenges for US citizens living abroad in this article. Now, I would like to discuss how to prepare for extended time spent outside of the country. This is the first and very important step for each expat, with plenty of details which may not always draw attention. Some steps are relatively simple and straight, others may present a real issue for those not familiar with a subject.

Preparing for the life in foreign country can be a challenging experience. By looking over the Internet, one can find plenty of advises. According to people familiar with the subject these are the most important steps in preparation process:

- decide whether your move is temporary or permanent: other steps depends on this decision

- estimate how much money would be required to maintain a familiar life style in a foreign country, and identify funds available to cover expenses

- make sure the US Passport (and possibly Driver’s License) are valid for extended time: it can be a challenge to renew them while outside of the country

- make copies of important documents

- get familiar with health care system and immigration law in a country of destination: obtain insurance/visa if required

- for those who own a property, figure out what to do with it: sell, rent out or let it stay empty

- for those who own a car: sell it, ask someone to drive it regularly or prepare for long term storage, also update/cancel car insurance and take care about registration

- take care about mail: forward it to some other address, or ask someone to collect it in your absence

- find out how to stay connected with banks, brokerage firms, US government and tax collection authorities

- study tax law in a country of destination, explore how to avoid double taxation since US citizens must pay tax anywhere in a world

- collect credit and debit cards with no Foreign Transaction Fee from banks or credit unions friendly to expats: it is better to have at least 3-4 cards, to make sure at least one of them would work

- cancel Internet service, home and cell phone plans: set up virtual US phone number, learn about international and local cellular providers and services

- prepare a supply of necessary medications, do research if they are available in a foreign country: if not, find the replacement

- cancel utilities, all non-essential services and memberships

While some of the steps seems trivial, others may require a separate article. Here, I would like to discuss a few of these points in more details.

Car storage and insurance

Obviously someone may consider keeping the car, especially when there is a place to store it. It is definitely a right choice to drive the car regularly for a short time. But just in case nobody is available for this exercise or you plan to be out of country for extended time, it is OK to leave it as is. Car battery must be disconnected for a long term storage. Otherwise, leakage current will completely drain the small battery which start the engine. It really does not matter if it is electric or gas car. In order to maintain a charge in the large electric vehicle battery, some sources recommend leaving it connected to the outlet. But this solution is for a relatively short absence and for a car stored in garage. It would take a long time for large battery to drain, a year or so. Still, it may be safer to store a gas than electric car due to various risks associated with a large battery. Selling the car would be still a better option for those who plan to be absent for years.

It is also better to have a limited insurance in case of car storage, because any gap would cause a premium increase later. Most insurance companies has a special rate for vehicles not in use. Also there are insurers which provide a rate per mile, such as Metromile for example. Car registration needs to be updated as well.

Home address

At this time, we all prefer to receive the bills and other important documents online in electronic format. But there may be exceptions such as credit or debit cards, state or federal government official communication including driver license or jury duty notice. They still come with regular mail, and can not be just ignored. How to handle them, while away from home? USPS has a service to hold mail during one month, which would not work in our case.

First, let us consider the case when expat still owns the residence but nobody live there. In this case, the best option would be to ask a trusted relative, friend or a neighbor to collect everything directly from the mail box. Also it would involve finding important letters, scanning them and sending the scan by email.

But what if the residence has been sold or rented out? Or there are no trusted people available around to collect mail right from the mail box? The next choice would be still to find someone trusted preferably living in the same state, and forward mail to that address. USPS provide a service to forward mail to another residential address in US for one year. Therefore, in addition to mail forward it is important to update address records with DMV, banks and other institutions. Be aware that Jury Commissioner’s Office receives the address from DMV or County Voter Registration Office.

Still, there might be the case when nobody is available or trusted to take care about the mail. The third option would be to rent a private virtual mail box. The service is not free, but they would register every piece of mail and by customer choice scan and send out by email anything of interest. Typically, such a service provide an ordinary mail address (not P.O. Box) in a state with no tax like TX for example. There are companies in service for many years and trusted by most customers: Post Scan Mail, Virtual Mail Box or US Global Mail.

Are there any potential problems with these three options? The first option which assume that someone would collect mail right from existing mail box would work fine, as long as the residence has not been sold or rented and it is possible to find someone local for this effort. It is also OK in most cases to forward/update mail to other residential address. However, some institutions may ask for verification with utility bill: ETrade and Schwab are known for that. Virtual mail box would likely be provided with a non-residential address in other state, which may not be accepted by certain brokerage firms or banks: details will be discussed in the next topic of this article.

Managing finances

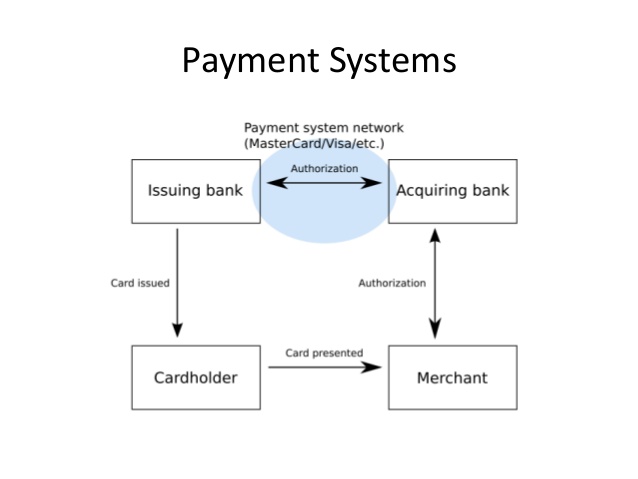

It is always advised to keep existing bank accounts, credit and debit cards while living abroad. The Foreign Account Tax Compliance Act (FATCA) and Patriot Act made an expat’s living a real challenge. It is hard for US citizen to open account in a foreign bank, because bank does not want to deal with FATCA compliance policies. But even worse, multiple US brokerage and bank accounts has been closed for citizens living outside of country. This is the main reason, why it is essential to keep US address for those organizations. As described above, there are at least three options for that. But still there is another problem: how to access bank accounts from the foreign country. Well known large banks and brokerage firms keep track of IP address, and they particularly do not like when someone registered with US address attend the web page from other country on a regular basic. This problem can be solved with trusted VPN service. One option is to use a shared IP from VPN which is associated with data center within US in the state matching the mail address of account holder. But some banks like Bank of America for example allow access to their accounts from residential IP only. There are VPN services providing a static IP for additional fee, which is recommended in this case. ExpressVPN, NordVPN and TorGuard are among the most well-known and trusted providers of virtual network.

Brokerage firms load expats with even more problems. US citizens living abroad are not allowed to invest in mutual funds, broker CDs and some other types of investments. In fact, some brokers such as ETrade or Vanguard are known for retirement accounts closure. Again, US address and VPN service are here to help. Also Schwab has international package designed specifically for those living in other countries. It is even possible to provide a foreign mail address in this case. However opportunities for investment in this package are limited. Still, it may be the only solution for people moved to other country for extremely long time or forever.

Credit and debit cards

While expats are facing problems to open account in foreign banks, US credit and debit cards are essential for living. It is important to prepare at least 3-4 different credit cards without foreign transaction fee. I did have a great experience abroad with the PenFed cards. At the moment, their platinum rewards card also provide a superior cash back for groceries. As regarding debit cards, Fidelity and Schwab really stand out of competition for ATM cash withdrawal: they even pay back ATM fees imposed by local bank. But cash management account is required. Sadly each card has an expiration date. Replacement card will be sent using US mail address. It might be difficult and expensive to collect a physical card, as someone must send it by international mail. By that reason, virtual payment systems like Apple Pay, Google Pay or Samsung Pay can be really handy in this situation. All they need are credit or debit card credentials, no real card required. These systems are already deployed in many countries.

The only alternative access to money beyond the cards would be wire transfer, but it is hard to accomplish without a local bank account. It may be a reasonable choice to consider Transferwise for those fortunate who managed to establish an account in foreign bank, due to their low cost transfers outside of US. Schwab, HSBC, Citibank, Alliant and Navy Federal are among expat friendly banks and credit unions recommended for international affairs.

Phone service

Finally, a few words about the phone service. Obviously US cellular service providers either does not work abroad, or charge ridiculous fees. GoogleFi is an exception, as it provide a data service at a reasonable cost in most countries. But you stuck to pay a monthly fee for voice service which is never used. Therefore, better solution would be to make sure cell phone is compatible with country’s standards and buy a local SIM card: in most countries, cellular service is much cheaper than in US. In order to keep US phone number, Google Voice is the best solution. Install Hangouts on a cell phone or tablet and enjoy free calls to and from US. Just in case if Google Voice by some reason is not available, Vonage also provide a free US number and there is no need to buy their service.

As discussed above, there are multiple challenges often faced by expats. But with a careful preparation, it is possible to address them well in advance and live a prosperous life in the country of choice.