Thinking about early retirement? There is no way you can afford the cost of living in your area? You are not alone. I live at one of the most expensive areas in the world: San Francisco Bay Area. Although my home is smaller than most homes around and the schools are not that great, I paid enormous amount of money for the mortgage and there is also a property tax attached which I have to pay until I die or move. Property tax is rising, together with home price on the market. Zillow is a great source of data, if you want to see an estimated market price for particular home year after year. Currently, my home price is estimated at $1,169K and in June 2009 it was just $619K. Great news, isn’t it? Yes if I want to sell it. However, if I want to live in this home for a long time, property tax will be growing: I already have to pay around $12K for this year. For comparison, my property tax was $8,380 in year 2009. It is easy to see, that property tax has not grown proportionally to the market home price. Thanks to California’s Proposition 13, assessed value for any home not being sold can not grow more than 2% annually. Therefore, currently market value is $1,169K (according to Zillow, you never know the real market price until you sell it) and county assessed value is $881K. As a result, the property tax is still high enough because I bought this home in year 2007 when selling price was almost $800K.

Can anyone retire in a home with annual property tax $12K which will most likely on a rise in future? It depends on the available liquid assets. The home price can be high, but you can not count on it while living in this home. Using 4 percent rule, it is easy to have a rough estimate how much money you actually need to afford this home based on projected cost of living. Also there is a great calculator available. It is true that most people with ordinary engineering income can not afford it and I am not an exception. What do I do then? Work until the age of 70? Another option is to move to other area with lower cost of living. How to determine which exactly area is the best fit? Well, it depends on your personal preference. For me, these are the most important factors I consider to make an educated choice:

- where you feel comfortable and enjoy a social life, presence of relatives and friends, favorite activities and shopping

- climate (I personally enjoy warm weather but not as hot as for example in Arizona)

- insurance cost (health, home, car)

- cost of living, including home or rent price

- property tax, sales tax, income tax

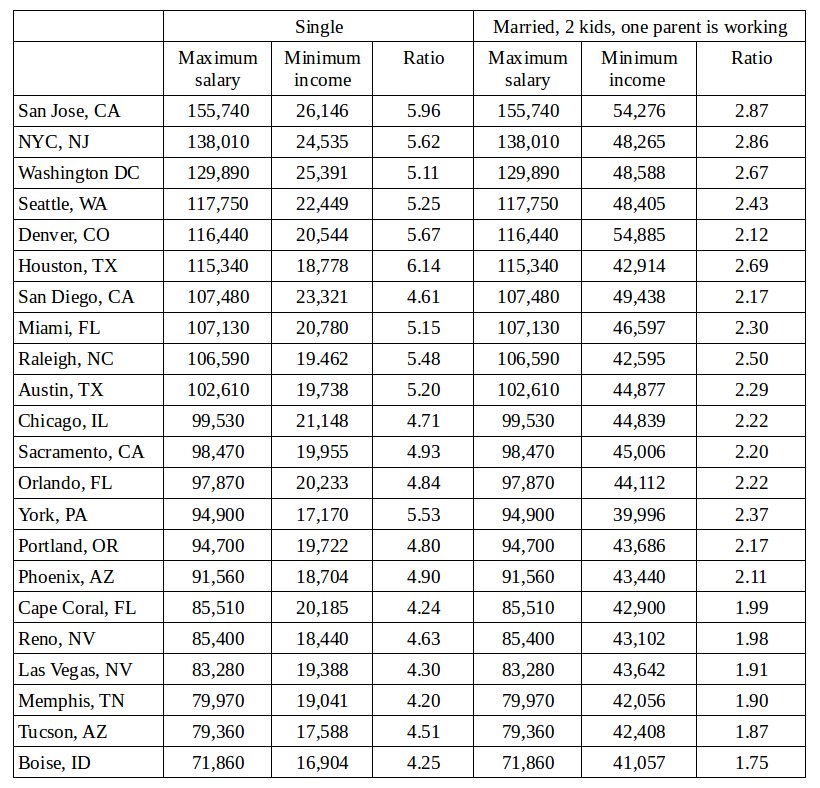

While feeling comfortable is a personal feeling, we can discuss other factors here. There is an excellent living wage calculator, provided by MIT for major metro areas in United States. I found it useful to compare not just absolute cost of living, but the ratio between maximum salary and minimum income required to live for single or married couple in the particular area. The ratio clearly show the areas where you will have the best bang for the buck, while continue to work. But if you are looking for a place to retire, then minimum income is the most important number to consider. Although not guaranteed, the areas with lower ratio and relatively high minimum income may also indicate the future home price increase. It may be good for investment home, but you do not want property tax to be on a steep rise when you retired. I combined the data for some areas into the table.

Actually I found this table quite interesting. Metro areas are sorted according to the maximum salary. According to the data, living in San Jose may give you better income stream if you manage to get higher compensation. But places like Houston provide even better standard of living for single person. From the other side, areas with minimum income $20K or less are great candidates for retirement location. But I would not completely rely on these numbers: you may need greater than that to live a quality life. But these numbers provide some guidance where to look.

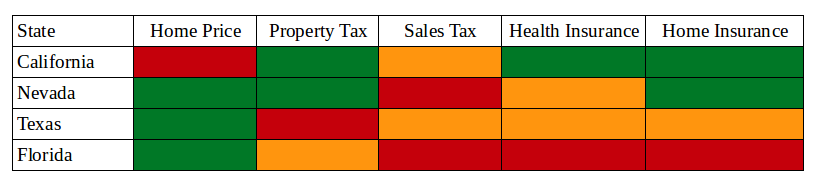

After carefully comparing different states and metro areas, I included a few places into my short list: California, Nevada, Texas and Florida. Is there anything common between these states? Of course, they enjoy warm climate around the year and there is no state income tax in all of them except California. But they are actually quite different in many other aspects. For tax purpose, I found this article quite useful. You can sort the table for property, sales or income tax, as well as for the total tax burden. Obviously, California is #11 in total tax burden, followed by Nevada #34, Texas #41, and Florida #44. However, not all taxes are equal in a retirement. If you are like me, income tax will not be a big deal during the retirement because of low tax bracket. Sales tax is definitely more important, but you always can live a frugal life by limiting the number of items you purchase. We all have to pay property tax, no matter what we do. Even those who rent are paying a property tax indirectly, through the rent. According to the table, the highest property tax burden is in Texas, followed by Florida, California and Nevada.

Another important factor is insurance, in particular health insurance. There is another great article on this subject. Apparently, California has the lowest health insurance rates in my list, followed by Texas, Nevada and Florida. In fact, health insurance cost in Nevada and Florida is quite high, compared to California and Texas. Home insurance is another important criteria for comparison. In Florida, home insurance can be as high as $5K annually in some counties (see the data) due to the potential hurricane damage, and it does not even include flooding insurance cost. In Texas the average cost is running about $1K per year, but can be higher at places like Galveston. I pay $512 annually for home insurance in California, which is apparently the lowest across all states of my choice. The home prices and income tax are terribly high in California, however home prices are quite different across metro areas. In this table, I summarized all findings.

Carefully considering all factors, I vote for metro areas in California with reasonable home prices. In addition to all these factors, I personally like climate in California more than anywhere else in United States. But I know other people may have different opinions. Home prices are sky high in San Francisco Bay Area and surrounding cities only. Around Los Angeles for example, you can find a descent home for half the price in Bay Area. Sacramento enjoy even lower prices. This is not just my opinion: prices in lower cost areas across California are rising, which means more people from high cost areas are moving there. Still, at this time I do see California as the most viable option for retirement.