Working people are painfully familiar with taxes. We all know employer typically withhold some money from each paycheck. There is a federal W-4 form where employee can change the amount of money taken away from the income. The same is true for state and local taxes. It is always a good idea to carefully estimate the total annual income and withhold exactly as required, to avoid unexpected surprises in annual tax return. But what if someone retired from regular job but still has passive income such as interest, capital gain, etc.? Tax still need to be withheld regularly or estimated payment must be made as IRS does not like anyone who delay tax obligations and may impose an underpayment penalty.

What kind of penalty is in place, when individual delays tax payments? Basic requirements from IRS are defined here. IRS expect anyone to make estimated tax payment if the tax of $1,000 or more will be due at the time of annual tax return. In case of the penalty IRS require to fill the form 2210 and the penalty amount due is essentially the interest charged for every day of delay. Most states has their own requirements. For example, in California individual is expected to pay estimated tax if the tax of $500 or more will be due at the time of annual tax return ($250 if married). Federal form 1040-ES must be filed for estimated tax either by mail or online. State of California form is 540-ES and payment options are available here.

Obviously, paying estimated tax is not as hard as it sounds. But is there any way to avoid it? This is what can be done.

- carefully study all conditions provided by IRS to escape from estimated tax payment i.e. safe harbors

- make a correct early estimation how much tax will be due by the end of the year, and what it takes to reduce it to the degree when advance payments are not required

These are three harbors or conditions to avoid estimated tax payment covered in part I of IRS Form 2210:

- The total tax for a current year tax return, with the exception of any refundable credits and the amount paid through withholding, is less than $1,000

- At least 90% of the amount calculated (before subtracting withholding) has been withheld for harbor one mentioned above

- At least 100% of the amount calculated has been withheld (110% when adjusted gross income for that year was greater than $150,000, or $75,000 if married filing separately) as a part of prior year tax return

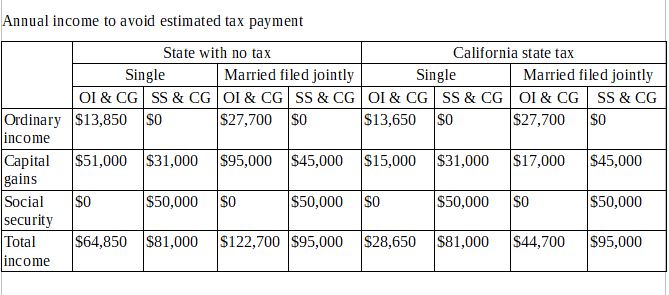

While these harbors might be sufficient for someone, there are always situations when estimated tax still can not be avoided. The good news is that estimated tax payment may not be necessary if the total income for tax year does not exceed certain number. Manipulations to fit those numbers would be also beneficial for retirees managing their income for ACA subsidies with Roth conversions as discussed in previous article. Anyone can estimate the magic number according to his/her specific situation using for example this great calculator. In a table below, I compiled some numbers typical for retirees to have an impression when estimated tax payment can be avoided.

In this table, three types of income are considered: ordinary (interest, short term gains), capital gains (qualified dividend and long term capital gain) and social security. California’s state is used as an example of progressive tax rate, opposite to the state with no income tax such as Nevada, Washington, Texas, etc. Apparently for people who did not file for social security yet, California state tax really makes a difference. Does it mean everyone should retire in the state without income tax? Not really, because the low income numbers may play in favor for those who manage income for ACA subsidy anyway. Also, there is not much difference once the person (or couple) file for social security because California is one of the states which does not tax social security.

Overall, the income limit numbers appear to be reasonable for many people. But someone might want more money to live on. It still possible, with the use of tax-free Roth IRA distributions. The great feature of this retirement engine is that these distributions are never counted towards the taxable income, even for ACA purpose. In states like California, it is even more beneficial to fund Roth IRA as much as possible in years before the retirement using Mega backdoor Roth conversion to take advantage of low tax environment later.