Retirement accounts such as 401K are quite popular. During the career time, anyone can put aside some money before income tax withheld. Currently, 401K annual contribution limit is $19,500 (with additional $6,500 for those older than 50), which can be combined with Heath Savings Account annual limit $3,550 (with additional $1,000 for those older than 55) for individuals and families signed up for High Deductible Health Plan. There is also traditional IRA with annual contribution limit $6,000 (with additional $1,000 for those older than 50). However, federal income tax is always due later at the time of distribution. Also, many states require paying additional tax on these distributions. For example, $100K in someone’s 401K may actually worth just $88K due to the 12% federal tax bracket. Retirement accounts are designed in assumption that the tax bracket would eventually get lower for people, when they withdraw money at retirement age. Which may not be always true, especially for those applied for Social Security Benefit later and experience Required Minimum Distributions (RMD) kicked in at 72. Essentially the tax on retirement accounts is a time bomb waiting to explode. Is it possible to withdraw money from retirement accounts and never pay tax? Actually it is possible, under certain conditions.

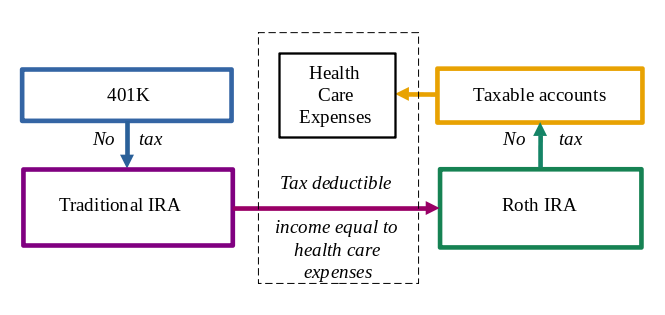

The reasonable first step for anyone who would like to withdraw money from 401K is to roll it over into traditional IRA. There is no tax associated with this rollover. It can be done for the entire account or part of it, even before retirement age. Though it works for former employer’s 401K only. There are multiple discussions about advantages and disadvantages of this step. In most cases, there is an advantage to keep retirement savings in traditional IRA, rather than 401K after separation from service. Also this is an important step before further actions are taken.

One way to avoid tax on IRA distribution is to transfer IRA money directly into Health Savings Account (HSA). This can be done once in a lifetime. HSA must be active (i.e. combined with qualified High Deductible Health Plan) and maintained for at least one year after the transfer is complete. HSA money spent on health care services are 100% tax-deductible. However, HSA annual contribution limit of $3,550 is still applicable. It makes such a transfer much less attractive. Also some accounts may have limited investment choices as well as other restrictions and fees.

Fortunately, there is a better way to avoid tax on IRA distributions. Medical and dental expenses which exceed 10% of annual Adjusted Gross Income (AGI) are tax-deductible when itemized deductions are used. While it is a rare case when anyone who spend more than 10% of annual income on health care during the career time, situation changes with income dropped due to the separation from workforce. This is especially useful for those who already retired but did not reach Medicare age. For example, with annual income around $20K it takes just $2,000 to become eligible for tax-free health care expenses. In fact, $2,000 may be spent just for health care insurance premiums. In this case, all actual health care expenses beyond insurance premiums become deductible. Higher health care expenses provide more tax advantage in this case.

But how does it relate to IRA distributions? Actually there is a direct link between tax- deductible health care expenses and IRA distributions. The annual amount of distribution can be adjusted to match health care expenses in excess of 10% AGI paid during the calendar year. It can be implemented even before the age of 59.5 with traditional IRA rollovers into Roth IRA: additional penalty 10% does not apply in this case. In this way, the matching part of distribution is essentially tax-free. How much money in total can be withdrawn tax-free? According to the reports, average retired American spend as much as $280K on health care alone during the lifetime. This is a decent part of 401K/IRA savings for ordinary people. Any tax-free IRA distributions are helpful to reduce RMD and eventually a tax burden during the later retirement years.

What if someone can manage to have a very low income, for example $5,000? Would this be even better, as it makes deductible any expenses beyond $500? Actually it is not. Anyone with annual income below Federal Poverty Level (FPL) which is $12,760 for individual and $17,240 for a family of 2 become eligible for free health care under ACA Medicaid Expansion. In this case, small income does not help: IRA distributions would be fully taxable, as health care expenses are non-existent or extremely low. To this extent, it is better to have higher income to take advantage of tax-free IRA distributions. But not too high, as it gradually reduce all benefits of tax-free distributions to zero. It appears the income between $17K and $25K per year is the best for that purpose.

Also another question may rise. What actually brings more advantage: reduce income to near zero and use free health care through Medicaid expansion, or maintain income in optimal range mentioned above and enjoy tax-free IRA distributions? It may appear beneficial to get health care for free. But it is for a limited time, till Social Security benefit and RMD kick in and the cost of health care would be substantially higher along with a high tax on IRA distributions. Therefore, the preference still come to the scenario of tax-free IRA distribution. The advantage would be even greater for those who live longer and therefore experience higher health care expenses.