As most of us already know, 401K plan from employer is a great tool to reduce the overall tax burden. Pretty much every one who has 401K at workplace can stash away up to $19K (or $25K for those over 50 years old) in before tax money annually from Uncle Sam. Money can be invested and grow tax-free, until the distribution when tax is still due. At the time of distribution individual must be over 59.5 years old and in the lowest possible tax bracket, in order to enjoy the full advantage of retirement benefit. But what about after tax 401K? More and more employers offer this benefit. How does it matter? What would be the reason to shelve away more money into 401K, if tax has been already paid? Let us figure it out.

There are three types of employer sponsored 401K contributions currently allowed by IRS:

- before tax (traditional)

- Roth

- after tax

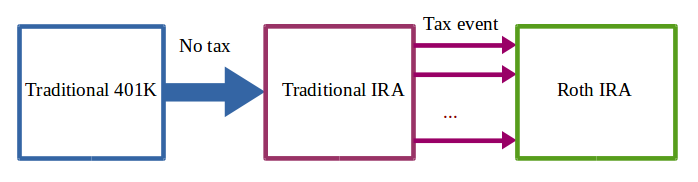

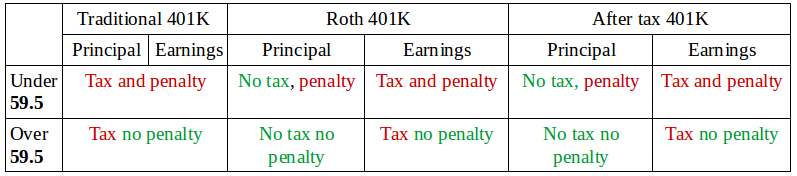

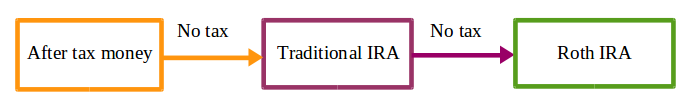

The primary type is a traditional 401K as we all know about it. Money are contributed directly by employer with each employee’s pay check on a pretax basis and can be matched by employer. Upon the distribution, federal tax is always due. Also the penalty is imposed if 401K money are distributed at the age under 59.5. Better but less known way of traditional 401K distribution is rollover into the traditional IRA account, which can serve as a temporary stop on the road towards Roth IRA. Since there is a tax event generated with traditional to Roth IRA transition, it is always recommended to transfer smaller amount each year to minimize an overall tax burden. Unfortunately, traditional 401K distributions can be taken after employee’s separation only.

The second type is Roth 401K: money are still contributed by employer with each employee’s pay check but on after tax basis. There may be an employer’s match subject to the total annual limit. Upon the distribution, no tax is due on principal since the tax has been already paid. However tax is due on any earnings generated while money are invested within Roth 401K. The third type is after tax 401K account, which is treated similar to 401K Roth with respect to tax but no employer match is provided.

The main difference between Roth 401K and after tax 401K is in contribution limit:

- total annual contribution limit for traditional and Roth 401K combined is $19K, or $25K for those over 50 and it does not include employer’s match

- total annual contribution limit for all three types of 401K accounts including employer’s match is $56K, or $62K for those over 50

At first, it appears, that after tax accounts does not make much sense. The tax on contribution has been already paid, and the tax on earnings is due at the time of distribution. While distributions still can be scheduled at the time of the lowest tax bracket in the future, the advantage depends on earnings generated by after tax investments. Most likely the tax advantage will be less than for traditional 401K.

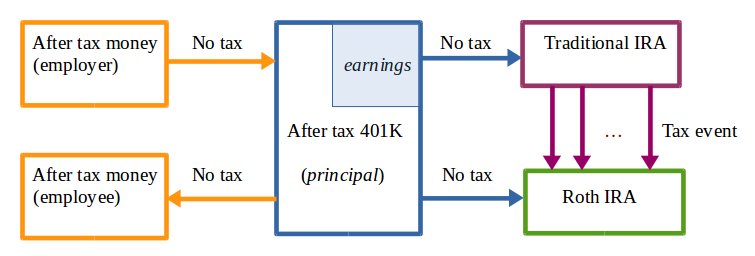

Situation changes when employer offer in-service distributions for after tax money. This would mean, that after tax money can be distributed while employee still work for the company. Moreover, the latest IRS regulation offer a split distribution of after tax 401K money: principal part can be rolled over into Roth IRA account, while earnings can be rolled over into traditional IRA. In this case, no tax is due at the time of distribution. Also after tax money (principal part) is available to employee at any time.

Why it matter if money are at employer sponsored 401K or personal IRA? There are a few potential advantages of personal IRA accounts:

- lower fees and unlimited choice of funds to invest

- less chance of changes in tax or distribution rules in future

- money can be distributed from personal Roth IRA with no tax (both principal and earnings) when certain conditions are met and there is no required minimum distribution rule

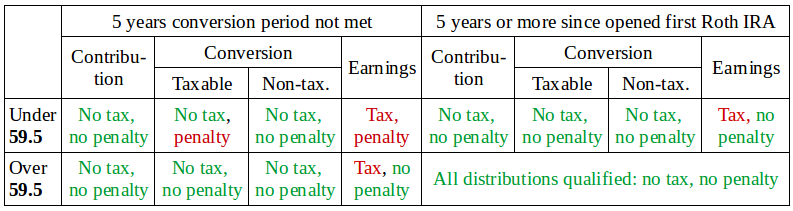

Indeed, personal Roth IRA by design is far better in a long run than other retirement accounts. But it is important to remember Roth IRA distribution rules:

While the advantage of Roth IRA is quite clear, traditional IRA rules may not be as great. Please remember the tax is due on before tax money distribution from traditional IRA, similar to tradition Roth IRA and required minimal distribution is in effect. Also before tax money at traditional IRA dramatically complicates the procedure of backdoor Roth conversion, as presented below. But this is the only way to contribute into Roth IRA for those with adjusted gross income more than $137K (single) or $203K (couple).

Is there a better solution? Apparently, there is. Given the complexity and tax implication of traditional IRA, it is better to have regular rollovers for entire after tax 401K money into personal Roth IRA, to make sure earnings are minimal and does not trigger any substantial tax during conversion:

- initiate contribution into employer’s sponsored after tax 401K up to the annual limit

- choose money market or other extremely conservative investment, to make sure earnings are minimal or nonexistent

- at the end of each month, initiate in-service distribution for entire amount at after tax 401K account into personal Roth IRA: no tax or very little tax will be due at that time

- invest converted money into any fund of choice within Roth IRA

- traditional or backdoor Roth IRA contribution limit remain in place, providing additional source of funding

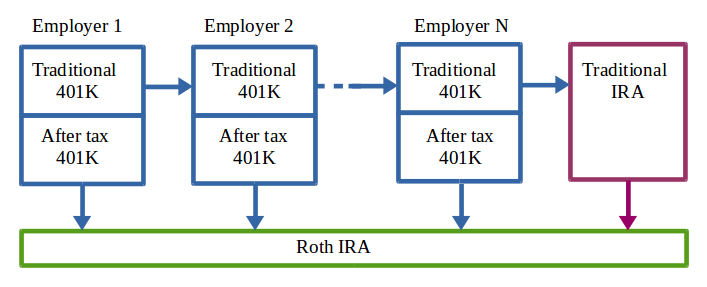

The procedure described above is often referred as Mega Backdoor Roth conversion. In order to combine both ordinary and mega backdoor conversions and maximize the amount of money rolled over into Roth IRA, it is important to follow the diagram below while being employed at one company or changing employers during the career time. It is better to avoid any traditional or after tax 401K roll over into traditional IRA as long as you are employed, apparently in a high tax bracket and doing backdoor Roth conversions every year.

It appears after tax 401K contributions can provide a great advantage, when handled appropriately. By doing this type of conversion, anyone regardless of compensation level can break the small annual Roth IRA contribution barrier imposed by IRS. It is currently defined as $6K, or $7K for those over 50. With the help of mega backdoor conversion, total annual contributions would raise to $62K or $69K respectively. But what about Roth 401K? Due to the relatively small annual limit imposed for the traditional and Roth 401K contributions combined, it does not look as a great option. However it may be make sense to invest into Roth 401K for people in relatively low tax bracket, who expect it to grow over the time.