Cash is a king. I do hear these words all the time. I bet you too. What is so special about the cash? It is dirty, inconvenient. It takes a space in your wallet. Yes, at some gas station like Arco gas is a bit cheaper, if you pay cash. At farmers markets, you can use cash only by obvious reason. Anything else? Yes there is another important reason why so many people hate credit cards: they spend much more using the card. Simply because they do not see the actual money to spend. Moreover, plenty of people have never paid their balance on time. They end up paying outrageous interest fee, and blame the card not habits they developed. The truth is: if you are like me, never buying anything extra in supermarket and paying your entire balance regularly on time then there is not a single reason why cash is any better than credit card. In fact, many credit cards come with generous reward programs. Even debit cards are better than cash, because some of them can be linked to high interest checking account.

Most credit cards pay from 1% to 5% cash back at this time. These are the cards without annual fee: I never apply for a credit card with annual fee. Although cards with annual fee may have better rewards, you are always required to spend a lot of money to take advantage of those rewards. But in fact, 5% is not that small. How much money do you spend using credit card? For example, if you spend $500 each months then $25 come back into your wallet as a reward. And these are your money, no tax or other reduction applied. Unfortunately, 5% cash back cards are rare these days, likely for a specific type of purchase and may come with conditions. For example, Fort Knox Visa Platinum Card pay 5% cash back on gas purchases at the pump, but require credit union membership. PenFed Platinum Rewards Visa Signature is another excellent card, which earn 5X points on gas and 3X on grocery stores. But it still require a credit union membership. Also, the points for this card are not exactly percents of cash back: one point is equal 0.85%, to be precise. There are other cards like Chase Freedom which I use from time to time with rotating categories. In year 2017 this card return 5% cash back on gas during the first quarter, and 5% on groceries during the second quarter. It may be difficult to remember and sign up for these categories, but you get a reward.

With respect to grocery stores, credit cards are not that generous. There are still some cards which return 3% cash back on groceries. Amex Blue Cash claim to do that, but Amex acceptance is limited and rewards can be earned at selective supermarkets only. Visa Signature Cash Rebates Card from Consumers Credit Union, which has a flat 3% cash return for grocery or convenience stores is definitely a better choice. Another important category are travel expenses: airfare, hotels, rental cars may eat up more of your money than anything else. If you like me travel overseas, then it is important to understand the amount of foreign transaction fee the card charge when used abroad. For all travel expenses, I use Barclay Arrival World Mastercard with 2.1% reward rate and 5% redemption bonus. Since it is no longer offered to public, another good example of travel card is PenFed Premium Travel Reward Amex card with 5X points cash back on travel expenses. But again please remember that 5X points are equal to 4.24%. Still, it is a great deal. Also, it worth to mention two other excellent credit cards I have, which pay 2% cash back on each and every purchase: Fidelity Rewards Visa Signature and Citi Double Cash. I use these cards for all purchases, other than gas, groceries and travel. Finally, there is another card which may deserve your attention: BankAmericard Better Balance Rewards. It simply returns $25 per quarter, when you pay more than a minimum balance each month.

A great alternative to cash back rewards credit cards are high interest checking accounts. For a long time, I did have super reward checking account at Provident Credit Union. For up to $25K deposit, expect to receive a generous 2% dividend when the following conditions are satisfied: make purchase of at least $300 each month using the debit or credit card from the same credit union, have a monthly direct deposit or ACH transfer to the account and enroll into electronic documents. Not a bad deal, taking into account that their credit card return 1.5% cash back in addition to the dividend. Another great example is Consumers Credit Union rewards checking account. It is not exactly better, but on my opinion more convenient than Provident’s high interest account and it has a few tiers. You can earn up to 3.09% dividend on up to $10K deposit after completing at least 12 debit card transactions each month, have a direct deposit or ACH debit transaction, enrolled into electronic documents and access account online at least one time in a month. There are higher tiers of this account which can earn up to 4.59% on $20K deposit. It all depends how much money do you have available to leave in the checking account, and how much money do you actually spend: the highest tier require $1K to spend each month using the credit card, which does not work well in my case.

The remaining question you may have after reading this article: which one is better, credit card with cash back or high interest checking account? In fact, they complement each other with a right strategy. Let us assume, that you have a spare $10K and ideally earn 3.09% or $309 per year when all conditions are met. How would you earn the same money with credit card? You need to spend at least $6180 in order to earn cash back $309. To this extent, rewards checking is superior to credit card. But please do not forget: you still need to make certain number of transactions with debit card. The best strategy is to have 12 small transactions per month as required, leaving those of higher amount for credit card in order to accumulate more cash back. This is how credit card can be complimentary to the debit card transactions and high interest checking.

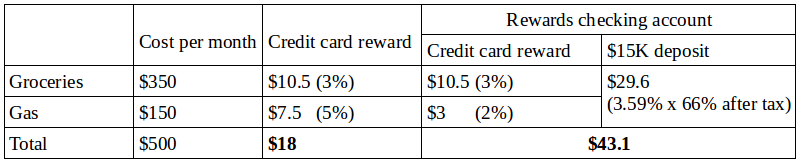

For the second tier with Consumers Credit Union checking account, you have to spend at least $500 each month using their credit card. As I mentioned before, it is a great card for groceries with 3% cash back reward and not so great for gas with 2% cash back reward. But ask yourself: do I spend that much on groceries every month? I do not. However, you earn 3% cash back combined with 3.59% on $15K deposit. What if you are like me, spending around $350 each month on groceries? The remaining $150 will earn 2% cash back for a gas, instead of 5% using other great cards I mentioned above. But according to the table below, it still worth the effort. The second column is a cash reward you can collect just using currently available cash rewards credit cards. The third column clearly demonstrates the advantage of high interest checking account combines with associated cash rewards credit card: in total, it is $43.1 per month compared to $18. In order to compute dividend from checking account, I use the highest tax bracket 34% for ordinary income: you may use lower whatever you have, then the advantage of checking account will be even greater.

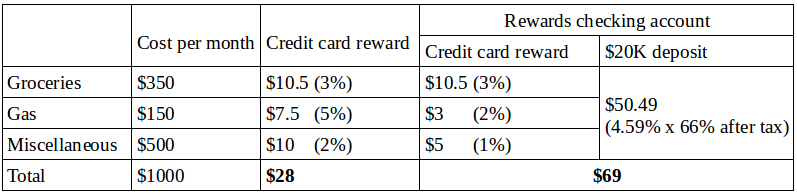

How about the highest tier, which require spending $1000 per month using credit card? I bet you never earn $918 per year, even if all other cards return 5% cash back (which is not a case, as discussed above). According to the table below, advantage of checking account with a highest tier is greater than in previous case: $69 per month, compared with $28. The only problem is that not everyone can spend $1K per month using credit card. At least, I find it very problematic for myself. But fortunately there is another strategy, which does not require you to spend that much money but still provide benefit greater than this tier.

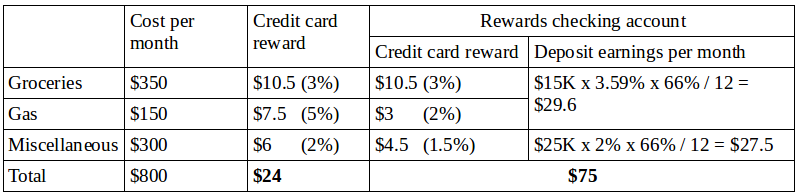

The strategy is to use Provident Credit Union high interest checking in combination with Consumers Credit Union high interest checking. In order to earn 2% dividend on $25K deposit at Provident, $300 must be spend using debit or credit card. I would recommend a cash reward credit card from Provident, because it returns 1.5% cash back for all purchases and does not have foreign transaction fee. In this case, you have to use Consumers credit card for groceries and gas to satisfy the second tier requirements, and Provident credit card for all other purchases up to $300. Combined with dividends from both checking accounts, this strategy return $75 per month compared to $24 with just credit card rewards and $69 with the highest tier from Consumers credit union.

The conclusion is simple: cash back credit cards, combined with high interest checking accounts from two credit unions is by far the best combination. Of course, if you have a spare $40K cash to deposit into checking accounts and you can afford to spend $800 each month using credit cards. But if you do, then it would be very difficult to beat this strategy.