Loosing a job can be a frustrating experience. Especially in Unites States. There are plenty of useful (and not so useful) articles on Internet, how to deal with this difficult situation. But my mission here is different. In this article, I would like to focus on financial aspect of the problem. Did you ever ask yourself: how much would I need to survive without a job? For how long? And what do I need to do, in order to have these funds readily available? If you did, then you are not alone.

It may sound as a surprise, but yes it is always possible to put aside some money to feel more secure about loosing a job. However, there is no free ride: in order to prepare for this unfortunate event, we need to earn more money. More money is always better. The federal poverty level (FPL) is $11,880 for a single person and $16,020 for a couple in year 2017. I bet you will not be able to put aside much money, if you earn less than 4X FPL. But for everyone earning more than that, i.e. $47,550 as a single, or $64,100 for a couple the opportunity exists. More money is better, however those with higher income pay more tax.

In other article, I provided some numbers for minimum income required to live in different metro areas in US: specifically, you would need anywhere from $17K to $26K per year to barely survive as a single person. For a couple with 2 kids, the numbers are higher but the range is smaller: $41K to $54K. Basically, anyone can put aside the difference between after tax money earned during the year and the minimum income stated above, which depends on each family situation and location. But obviously, in a real life you would need more than bare minimum to live.

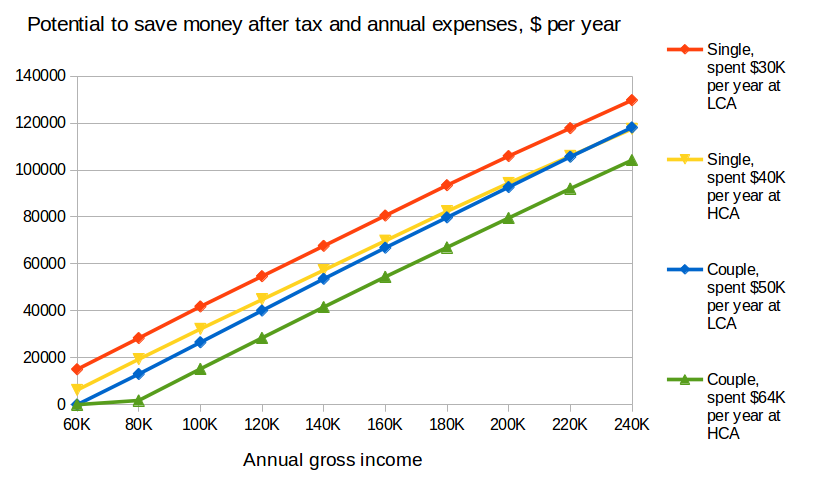

According to my observation, a low cost of living area (LCA) like Boise, ID gives an opportunity for a single person to live well on $30K per year, while $50K per year would be required for couple. But in a high cost of living area (HCA), such as Walnut Creek, CA for example, these numbers are obviously higher, reaching $40K (for single) and $64K (for couple). In a chart below, you can see how much money an average person can put aside, based on family size and the cost of living in his or her area. The numbers are calculated taking into account federal and state tax for Idaho and California respectively. As you can see, those living in a low cost area and earning $60K to $80K annually can save up to $30K each year. For people with higher income, the number grows linearly and may reach as much as $120K per year, even if they live in a high cost area.

These are after tax money. I intentionally use this simple example to demonstrate, what kind of numbers are reasonable here. But in a real life, most people contribute before tax money into 401K plan. In this case, $18K per year (or $24K per year if you are over 50) can be put aside immediately. This may add $6K to $8K additional savings per year for a single person, and $12K to $16K for a couple. However, 401K money will be available after 59.5 and a tax still must be paid when funds are withdrawn.

But how much money do we need, to live without a job for a while? The obvious answer would be just to combine the cost of living over the time. For example if you need $30K per year, then $150K must be readily available to live for 5 years. But this solution is too simple. First, there is an inflation which reduces the buying power of our money over the time. Second, we may not want just to run out of money at some time in the future. Actually, much better choice would be to invest money and live on interest or dividends. In this way, there is almost no risk to be left without money. Also, you may want to leave some heritage behind for the family members. Four percent rule is a great rule to follow in this case.

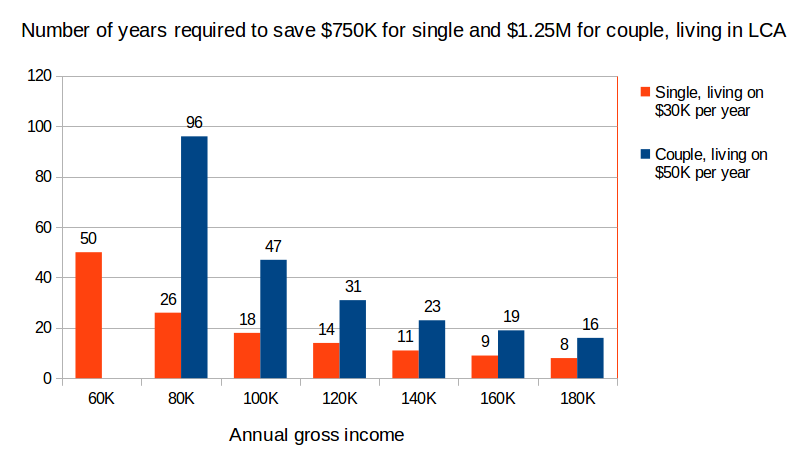

According to the rule, 4% of the total assets can be safely withdrawn each year, without significant damage to the principal. It is assumed, in any market condition 4% return on investment is possible. With this rule, it is easy to see that in a low cost area (LCA) where a single person need $30K and a couple need $50K per year, the total assets of $750K for single and $1250K for a couple are required. According to the chart below, the couple making greater than $120K annually may be able to put aside $1250K during 31 years. From the other side, for a single person the magic number of $750K can be reached after 26 years, even if the annual gross income is around $80K. With higher income, the number of years can be reduced by more than half in extreme cases at the high end of income range. Also, as you may noticed higher income does not directly translate into substantially shorter time for those making more than $140K per year.

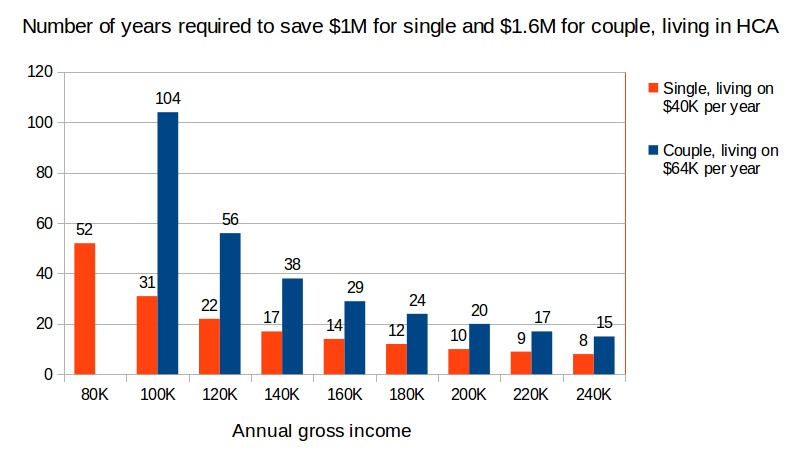

In a high cost of living area (HCA), a couple need to earn at least $160K annually, in order to reduce the number of years to reasonable 29 years. For single person, there are better opportunities: even $100K of annual gross income would be enough to collect $1M in 31 years. Similar to the low cost area, further gross income increase would reduce the number of years by more than half. For example, those with a very high income around $200K can put aside $1M after just 10 years of career. Clearly, higher gross income is better. But as I already mentioned above, income higher than $180K would not cause a dramatic reduction in the number of years, required to save $1M for single or $1.6M for couple. The time is at least 2X longer for couples, which seems reasonable: it is much better when both family members are working, then the numbers will get closer or even outperform the numbers for single.