It is well known, that staying rich and healthy is better than the opposite. However, it is also not a secret that many people prefer to stay poor, because of the multiple benefits they are eligible for in this country. But when anyone eventually gets sick, affordable and accessible health care is extremely important. In this article, I wanted to share some observations I had regarding health insurance currently available through the states exchange and apparently more expensive for people with lower income.

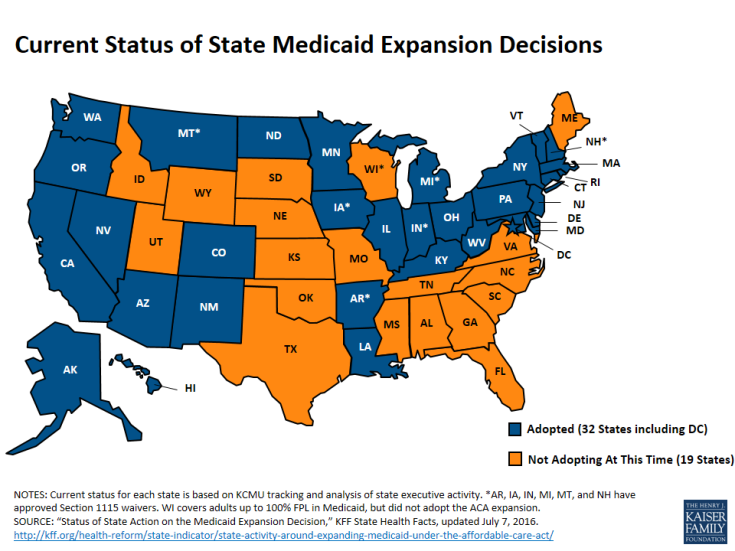

For many decades, Medicaid served as a public insurance option for those who does not have money to buy insurance and has no access to employer’s benefits. But strict requirements on income, assets and family situation still kept many people uninsured. Since Affordable Care Act (ACA) implemented in 2014, 32 US states signed up for Medicaid expansion. It is an integral part of ACA, substantially relaxing original Medicaid requirements. Pretty much everyone with income less than 138% of Federal Poverty Level (FPL) is eligible for this program. These are the states signed up for the expansion (according to Kaiser Family Foundation).

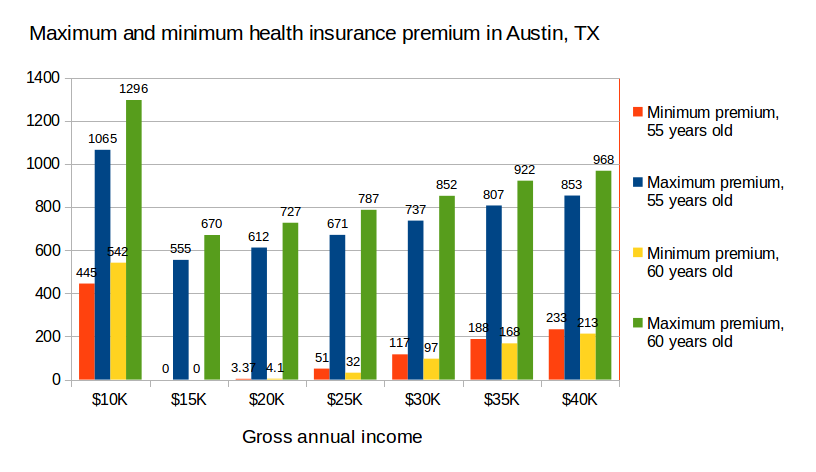

What happened to the states, which did not sign up (yellow color on picture above)? Using the main exchange website healthcare.gov, as well as Covered California I collected some data for the insurance premium range, with respect to the annual gross income and age. These are the data for Austin, TX. Apparently, people with less than $15K annual income must pay the entire insurance price, without any subsidies. Situation changes around $15K: there are some plans available for free. For larger income, the prices are gradually climbing, because subsidies are phasing out. But they do not reach the numbers offered to people with $10K income even with $40K income!

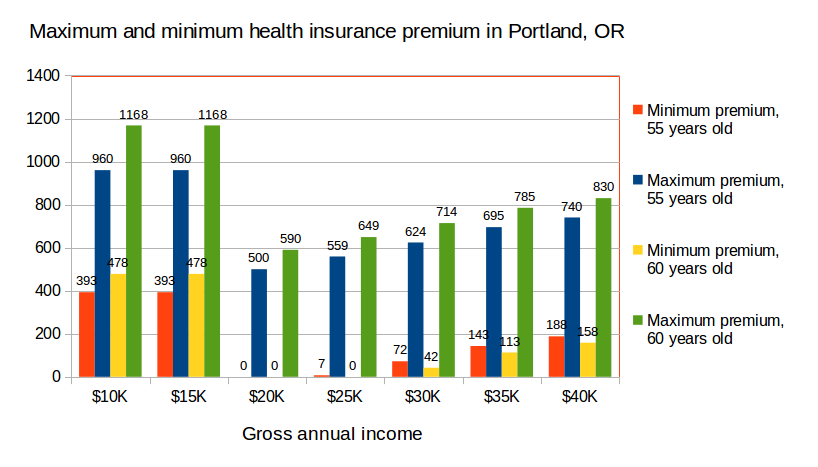

The other chart I have, is for Portland, OR. Oregon signed up for Medicaid expansion, but the exchange site still return some numbers. And for those with income below $20K , the numbers are very high. Compared to the above chart for Austin, TX, the entire data are shifted right as subsidies are starting at $20K rather than $15K, then premiums are gradually raising but both maximum and minimum numbers are definitely lower than correspondent numbers for Austin, TX. Also, the minimum premium appears to be always lower for a person of 60 years old, compared to 55 years old for both Austin and Portland.

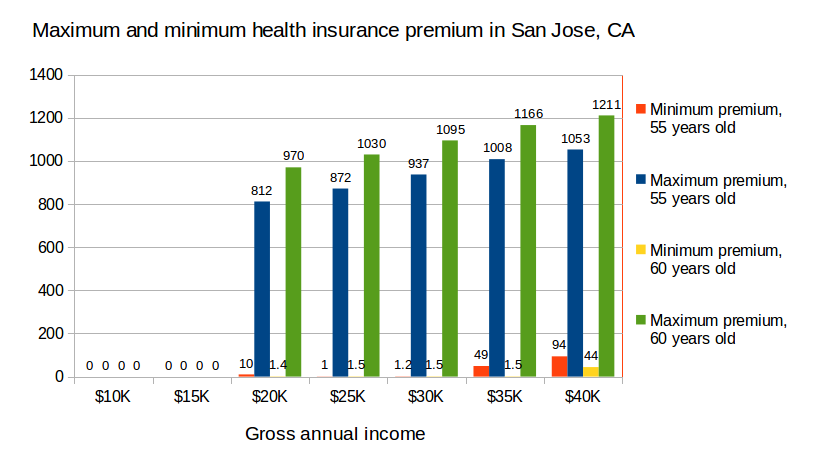

Finally, I decided to publish similar chart for one of the most expensive places in US: San Jose, CA. Covered California site does not return any numbers for those with annual income less than $20K: the message direct users to Medi-Cal (California Medicaid), explaining that with this income free or extremely low cost insurance is available. This is why I put zeroes there. With income $20K and above, a wide choice of insurance plans is offered with minimum numbers running around zero up to $35K income (which is substantially higher than for Austin or Portland) and maximum numbers well above other places. Minimum price decrease with age, similar to the above charts.

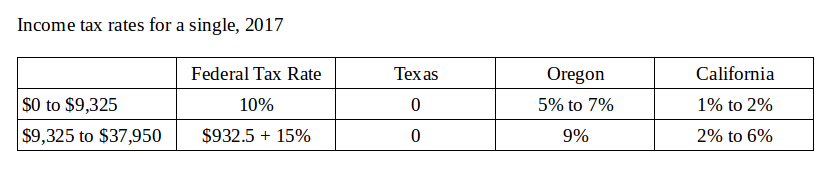

It is very important to be aware about the Medicaid expansion, because many people fall into the category with low income when they laid off or fired and unable to find another job for extended period. Unfortunately, Medicaid expansion will be terminated, if the repeal process is successful. Therefore, the Texas model will be likely extended into the entire country. What does it mean? You need to have an income above 138% of FPL, in order to be eligible for health insurance tax credit. One way to increase income is actually converting small portion of 401K into Roth IRA, which will generate tax event but extend annual income to be qualified. As Texas example demonstrate, the difference can be quite significant: as high as $500 per month, which will result in $6K per year. How does it compare to the tax, generated by the Roth conversion? You can see the tax rate table below. It may generate total 20% tax in a worst case, which would be $5K per year for $25K annual income. Still, less, than the premium advantage. Of course, much more savings comes from deductable and out-of-pocket expenses. But this was the worst case. In the best case (no state income tax) the federal tax of $2.5K per year would be a deal.