Retirement account is a great way to hide your money from Uncle Sam. It is especially nice for those in higher tax brackets. But it is also well known, that in most cases we have to wait till the age of 59.5 to avoid a penalty on retirement funds distribution. There are a few exceptions, but these are special life events and definitely not for everyone. However there is a better way to avoid a penalty suitable pretty much for every person and most people do not know about it. We will focus on it in this article.

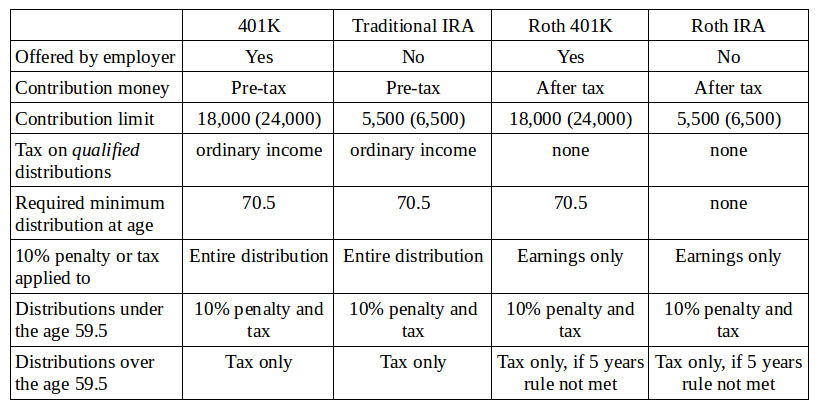

First of all, we can briefly go over the main types of retirement accounts: 401K (offered by employer) and traditional IRA is at one side, while Roth 401K (offered by employer) and Roth IRA are at other side. Both 401K and traditional IRA provides an opportunity to invest pre-tax money, while after-tax money are accumulated within Roth 401K or Roth IRA. All four types of accounts allows growing money tax free. But distributions from 401K and traditional IRA are considered as ordinary income and tax must be paid. Distributions from Roth accounts are tax free, but with restrictions. There are also annual contribution limits for all retirement accounts. For more details about each account type, please see the table below. Some extra opportunities exist, for example after tax contributions still can be made into traditional IRA. Other account types like solo 401K, 403B, SEP IRA, simple IRA, health savings accounts are outside of our discussion for now.

All these accounts are designed to fund our retirement years. It is permitted to withdraw money from 401K or traditional IRA penalty free (but not tax free) and from Roth 401K or Roth IRA penalty and tax free at the age of 59.5 or later (often referred as qualified distributions). It works for most people. Why would anyone want to take distributions before that age? There could be some reasons of doing that:

- running out of money because of the job loss or other unfortunate event

- return on after tax money investment outperform retirement account earnings

- in anticipation of tax increase on future pre-tax money distributions

Actually there are legal options to take early distributions from retirement accounts without penalty:

- owner become disabled or passed away

- funeral expenses

- some 401K plans allow penalty free withdrawal, after employee’s voluntary or involuntary job termination at the age of 55 or older (at the age of 50 for certain public services)

- medical expenses not paid by insurance for owner, spouse or dependents

- purchase of the principal residence and certain expenses to repair damage for principal residence

- payment of college tuition and related educational expenses

- payments necessary to prevent eviction of the owner from principal residence or mortgage foreclosure

- result of qualified domestic relations order (QDRO)

- substantially equal periodic payments (SEPP, rule 72(t))

In fact, almost all options are related to hardship or special life changing situations. Except for the last one, which is our primary focus now. The good news is, pretty much anyone can take money from retirement account following certain rules and pay no penalty. Tax is still imposed on all distributions, including Roth accounts. Therefore, this option does not make much sense for early withdrawal from Roth 401K or Roth IRA because these are already after tax money. But it can work very well for 401K or traditional IRA with one catch: it must be 401K from the former employer. Three methods are available:

- required minimum distribution method based on life expectancy of the owner, using IRS tables for required minimum distribution

- fixed amortization method over the life expectancy of the owner

- fixed annuity method, using an annuity factor from a reasonable mortality table provided by IRS

Basically, the funds are placed into SEPP plan which pays annual distributions for five years or until the owner reach 59.5 age (whichever comes later). The plan can be terminated by the account owner, but with severe outcome: all avoided penalties must be repaid to IRS combined with interest. It is important, that the amount of annual distributions meet one of three IRS approved methods described above. The largest and most reasonable amount is offered by amortization method, when annual payments are fixed. More details are available on 72(t) website. In order to execute the plan, an individual need to make the following steps:

- calculate the amount using IRS tables

- withdraw money annually for five years or until he or she reaches 59.5 age

- correctly report distributions in tax return every year

How much money is permitted to withdraw each year from retirement account penalty free before reaching the age of 59.5? There are some examples provided by IRS here. Bob, age 50 is the owner of IRA with account balance $400K and has his interest estimated as 2.98% (120% of the applicable federal mid-term rate). He would be able to withdraw $12,261 using required minimum distribution method, $18,811 under fixed amortization method and $18,740 under fixed annuity method annually. Obviously, the amount would be higher with a greater balance on retirement account.

With careful planning, early SEPP distributions from 401K can be combined with tax reduction strategy I outlined before: distributions equal to the tax deductions would eliminate federal tax completely. It is not possible to deduct the entire property tax anymore, but up to $10K local and state tax deduction combined with standard $12K deduction are still available. According to the 2018 tax reform, single person can have up to $22K deducted from the income which is a reasonable amount to live a simple life at most places across United States.