Retirement accounts such as 401K or traditional IRA are quite popular, because they provide a way for working people to effectively reduce tax on a part of their income. Anyone with earned income can accumulate some money in these accounts before tax, subject to annual limit. Then, money can be withdrawn later (in particular after the age of 59.5) in assumption of low tax bracket and less tax due. Sound great, isn’t it? I would argue that while this delayed tax would be definitely lower for many people, the benefit does not seem to be as good as it supposes to be. In fact, some people may not see any benefit at all. Let us discuss it in more details.

Many people continue to work after the age of 59.5 by different reasons. One important reason is a health insurance: popular Medicare program is available to those older than 65 only, and health insurance between 60 and 65 can be really expensive. Some people manage to stop working earlier, because they have a steady income such as investment, for example. In both cases, tax bracket remain high enough to delay retirement distributions. Delay for how long? At the age of 70.5, minimum distribution is required by law. As a result, people must pay tax on their combined income including social security benefit.

How to get the real benefit out of the pretax money? Of course, it is possible just to stop working early and reduce taxes to almost zero. In order to prevent this to happen, penalty is applied to those taking money out of the retirement account before the age of 59.5. There are ways to avoid penalty when some special event happen or by taking periodic payments (SEPP, as already discussed in this article). While special events does not apply to everyone, SEPP has its own issues. The amount of distribution is limited, and once started it cannot be stopped or delayed until the scheduled period is over, eventually leading to higher tax. Fortunately, there is another way to transfer pretax money into after tax account without penalty. Combined with additional planning effort and smart choices, it would be possible to enjoy a true value of retirement money.

In brief, the strategy look like this:

- transfer 401K money from previous employer’s account into your personal traditional IRA account: no tax paid at this time

- roll over a part of your money in traditional IRA account into Roth IRA: this is a tax event, so it must be done during the years when overall tax is low or non-existent

- Roth IRA money will grow tax-free, and will be available to withdraw without any tax or penalty after five years with no required minimum distribution

First, it is important to notice that if someone is working for one employer (or self-employed) for the entire life and has a single 401K then the plan would not work. But in current economic conditions it is quite rare: according to the Bureau of Labor Statistics, in average people change their employer every 4.2 years. So there is plenty of room to implement this strategy. Otherwise, the rollover of former 401K funds into traditional IRA is available at any time. It is actually worth to consider 401K rollover anyway because traditional IRA typically offer more investment choices and fewer fees than 401K. There may be a conversion fee, but it is typically less when rollover made between accounts of the same brokerage firm. There is no annual IRA fee at Fidelity, for example.

Then, the most interesting question is: when to convert traditional IRA money into Roth IRA, and how much? By the end of calendar year, evaluate your income and estimate how much tax will be due. If income is much lower than usual, then it is a time to take this step. It may happen due to the job loss, health issues, family emergency or many other reasons. According to the recent tax reform, single person is entitled to take $12K ($24K for married couple) as a standard deduction. Also it is possible to deduct up to $10K out of local or property taxes. This would mean, that there will be no federal tax on $22K (or $34K for couple) IRA conversion with no other income source. Still, low tax bracket 12% will be applied for those with annual income up to $38,700 (single filers) or $77,400 (couples).

As regarding Roth IRA money availability, it is important to understand two five-year rules applicable here. The first rule is designed for Roth contributions. As you probably know, anyone can contribute into Roth IRA (subject to annual limit). There is also a limit on earned annual income, but backdoor Roth conversion helps to overcome this challenge. This rule states that any qualified distributions (no penalty and no tax including earnings) can be made in five years after the first contribution is made to Roth IRA, and after Roth IRA owner turns 59.5 (both conditions must be satisfied). The second rule is designed for Roth conversions (which is a subject of this article): five years period is required before money converted from traditional IRA (principal only, no earnings included) can be distributed to owner tax and penalty free. The owner actually has a choice: make distribution or delay it, as there will be no required minimum distribution. More details about Roth IRA rules are available here.

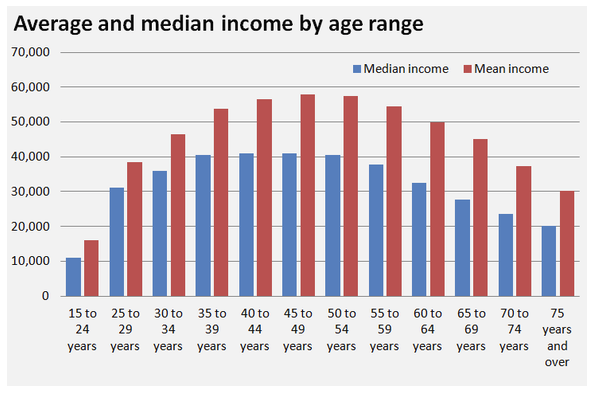

Also it may be a smart choice to make conversions earlier in career, rather than later. According to the recent Census Bureau’s Population Survey, both median and mean income (and associated tax) tend to be lower for those younger than 30, reach a peak around 50 and steadily decline afterwards (please see the plot below). Obviously, making conversions after 55 would be justified too. It is just a matter how much money is still available in pretax accounts and what is a plan to stop working and applying for social security benefit. As previously explained, it may be wise to apply as early as possible. But Roth conversions must be taken into account.

But what if someone did not have much money to convert, when younger than 30? No reason to worry: recession will help. Yes recession can be an extremely good time, especially if it does not last long. Those of us working in corporate world, are painfully aware about these events hitting US market almost every decade. Most people still remember a few recent market downturns, which happened around 1990-1991, 2001 and 2008-2009. While it has been relatively quick recovery after 2001, it was at much slower rate after 2009 and especially after 1991. What does this mean? Assuming that the average person is employed between the age of 25 and 60, there are 3-4 recessions to survive during an active career time. While some of us were lucky to be employed, many people experienced layoffs during the recession years. This is a great chance to enjoy a lower tax rate, if there are money available to live. It is a well-known advise to have savings in after tax money for at least 10-12 months of living to survive this imminent failure of capitalist labor market. I would argue that savings for up to 3 years of living expenses would be a smarter choice.

Of course, it is hard to say if this strategy would work for everybody: it really depends on individual situation. One problem is Roth five-year rule, which makes Roth IRA conversions meaningless for those 55 years old and beyond. Because in less than five years, 401K money would be available penalty free anyway. Anyway, planning well ahead definitely helps to reduce tax and finally deliver more well-deserved money into our pockets.