Today, I would like to discuss Certificate of Deposit (CD). As you may already know, this is basically a savings certificate issued by commercial banks with interest rate fixed till maturity date. CD is actually a debt issued by bank to raise money. Higher interest rate is typically attached to longer term before the maturity. Before the maturity date, money availability is restricted. Usually, owner must pay a fine to withdraw the money before maturity date for CD sold directly by bank or credit union. Therefore, it is better to keep money till maturity. The good news is that deposits are FDIC insured, which means there is virtually no risk of loosing money. The bad news is that CD earns less money than other types of investments. Apparently, this is one of the most conservative forms of investment, with minimal risk and minimal return.

Why would anyone be interested in CD? It depends. For many years since the last recession, CD interest rate barely reached 0.5%. Together with great gains in a stock market, it appeared as a really bad idea to invest into CD due to historic low return. But situation changed. In year 2018, we were living in a different environment with Fed’s interest rate hike every quarter and stock market moving into a bear territory. At this time, investing into CD might be a good idea. But still many questions remain. What will happen with interest rate during the next 2-5 years? How much additional tax to pay, if someone is already in high tax bracket? What if there is a real need for money before the maturity date?

Investor in a high tax bracket may actually consider buying brokerage CD. They are sold by Fidelity, Vanguard and other brokers. Broker buy those deposits from banks. The rates are actually a bit higher than CD sold directly by bank. Brokerage CD may be purchased within IRA or other retirement accounts, which makes them tax efficient. But there are a few things to watch. First, make sure CD is FDIC insured. Deposits sold by US banks are typically insured. Second, look for call protected CD. Primary issuer may call CD back before the maturity date to lower interest rate, when Fed’s rate is too low. This will ultimately break a ladder. Finally, there might be new issue or secondary CD which are nearly identical. Secondary deposits are sold by broker with discount due to the investors who get rid of them before the maturity date. No penalty is applied, but principal may be lower than it would be at maturity date. This is a poor choice for a person selling CD before its term over, but good for a buyer who will experience a better yield.

For those in a low tax bracket, investing into CD is easy: choose a bank or credit union, transfer the money, determine the desired maturity date and buy CD. The only issue could be CD term, because 5 years may look to far down the road and 1 year may not have a decent interest rate. Exactly by that reason, CD ladder is designed. Break the entire amount of money into five equal parts, then buy five different CD: one for five years term, another for four, three, two and one year. After the shortest one mature, buy CD with the longest term which is five years in our example. Do the same with others, upon their maturity. Because of this approach, investor may enjoy a higher interest rate in future or consider investing somewhere else if stock market collapses. Of course, there is also an exposure to lower interest rate. But as it looks now, low interest rate is not likely to return for the next five years.

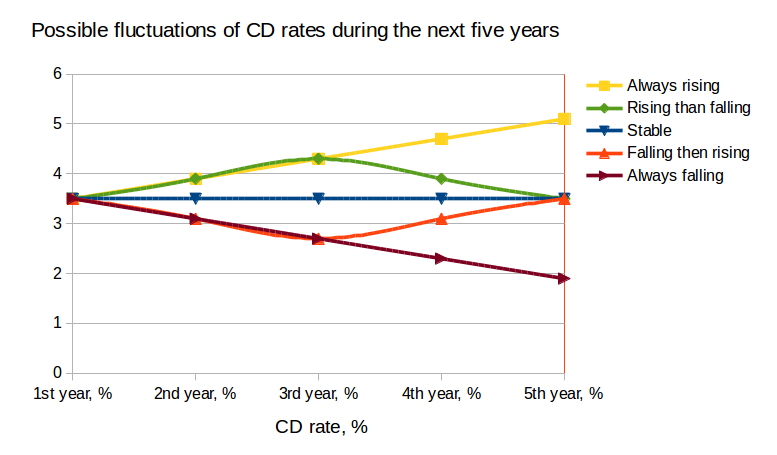

In order to account for future interest rate fluctuation, I consider five different scenarios for the next five years: always rising, rising then falling, stable, falling then rising and always falling. You can see the rate numbers in different colors on a graph. Of course, it is highly unlikely to have a stable rate, as well as always falling rate. The most likely scenario is actually a green curve, which reflects our current rising interest rate with a possibility to fall at some time when the next recession hit hard. Yellow curve is another possible but less likely scenario. I use 3.5% as a current interest rate for five years term CD, with 3.4%, 3.25%, 3.1% and 2.75% for four, three, two and one year respectively.

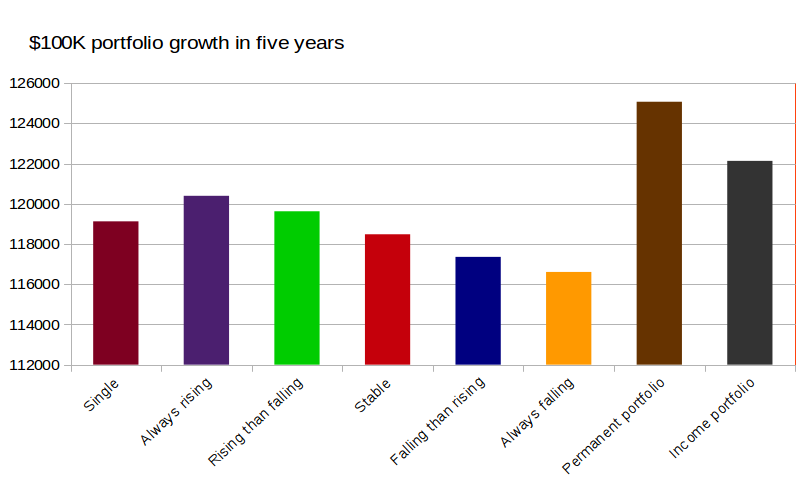

For the above scenarios, let us calculate $100K portfolio growth. It is easy to scale it to any other amount of money, closer to your portfolio. Single CD scenario means that all money come into a single five years term CD with current interest rate which is 3.5%, which is not a CD ladder. For a comparison, I also put the return by permanent and income portfolios during the past five years discussed in one of the previous articles.

What do we see? With most likely scenarios (green and purple colors) CD ladder will actually outperform a single CD. This is a great news, since as I already mentioned above it also provide a greater flexibility. Of course all deposits earn less compared even to the most conservative income portfolio. But the difference is not that significant. Also, please remember money invested into those portfolios are not FDIC insured and past performance is never guaranteed for a future.

It is always a personal decision, whether to invest into CD ladder or not. Under certain conditions, I would consider it as a decent conservative investment which may provide a little safe heaven from the great volatility of stock market.