In this article, I would like to discuss Roth conversions. Roth IRA is a powerful retirement engine which can generate a tax-free income for life. There are a few options to contribute money into Roth IRA account which can be opened with any brokerage firm or even some banks:

- direct contribution (limited to $6K per year or $7K for those older than 50, income limit $144K for individual and $214K for couple also applies)

- backdoor contribution (also limited to $6K and $7K per year, but no income limit)

- mega backdoor contribution (limited to $61K per year or $67.5K for those older than 50 which include 401K pretax, after tax, employer match and any other non-elective employer contributions: no income limit)

- Roth conversion (no limits but tax implication)

While backdoor contribution is available pretty much to everyone with earned income, direct contribution is subject to income restrictions and mega backdoor contribution must be available through the employer’s 401K plan administrator. But with backdoor, contribution limit is low. Also early in 2022, there was an attempt from US government to eliminate backdoor and mega backdoor provisions entirely. It did not succeed in Congress, but there is still a great chance the lawmakers will get rid of this back door soon.

Based on the above, the only viable option for most people to fund their Roth IRA with reasonable amount of money would be Roth conversions and this is a subject for our discussion. Under Roth conversion rule, anyone can convert some money from traditional (or rollover) IRA into Roth IRA. There are no age or amount restrictions. But if traditional IRA has been funded with pretax money, ordinary income tax is due on the entire amount being converted.

The tax implication can be a serious problem. Therefore, it is reasonable to do Roth conversions in a low tax bracket and likely with reasonably small amount of money converted each year. Many of those who retire early prefer to complete most Roth conversions before they turn 65 years old, which means health insurance from marketplace have to be purchased at the same time. ACA provide a subsidy for insurance premiums based on the income. By that reason, Roth conversions must be managed carefully to maintain the overall tax burden reasonable, in order to achieve the conversion goal.

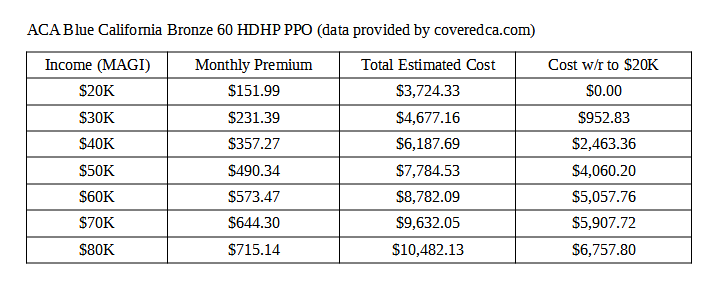

What would be the reasonable amount of money to convert then? There is no simple answer to this question. It really depends on income (in particular, Modified Adjusted Gross Income or MAGI) and health insurance details. Insurance premium subsidies may vary substantially with the insurer, zip code and particular plan being used. I compiled a table for ACA Blue California Bronze 60 HDHP PPO plan available at major metro areas in California, as an example. For the base income, I use $20K as a reference because it is pretty much the lowest income to purchase ACA plans (Medicaid expansion which is out of the current discussion can be used by those with lower income).

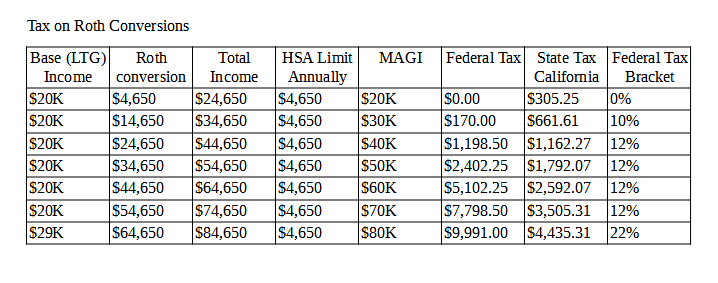

In the table, the total estimated cost is the number we will be using in other calculations. For convenience, the last column has the cost with respect to $20K MAGI provided by the first row in a table. Our goal is to figure out how long it will take to offset the health care cost by Roth conversions, in particular by the gain achieved within the Roth IRA which has all converted money in it. But for that purpose, we also would like to know the total tax due to the Roth conversion, to add it up to health insurance cost. The table below represent the individual federal tax and state of California tax implied for different amount of Roth conversion while base income $20K remain unchanged. We assume the base income is long term gain and taxed accordingly. For MAGI calculation, maximum HSA contribution is subtracted from the total income because in our example we have High Deductible plan accompanied by Health Savings Account (HSA).

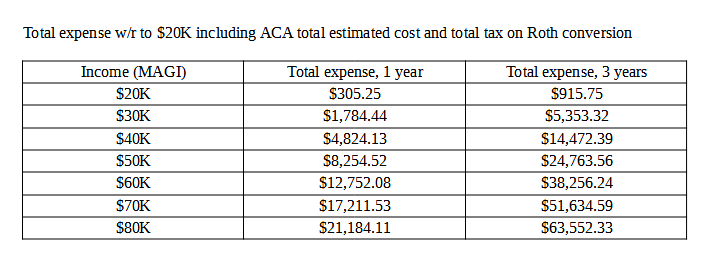

By combining ACA estimated cost from the first table and total tax burden from the second table, we have the total amount of money spent due to the Roth conversion (see the table below). We also want to see the same data for three years, in order to compare them with one year conversion results.

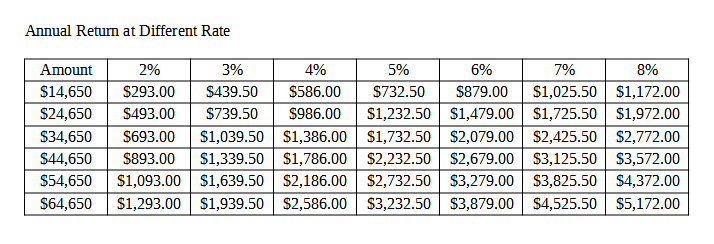

Finally, we need to calculate the return potentially generated due to the Roth conversion assuming it will be most likely anywhere between 2% and 8% annually. No tax will be paid on the return, since these funds are in Roth IRA.

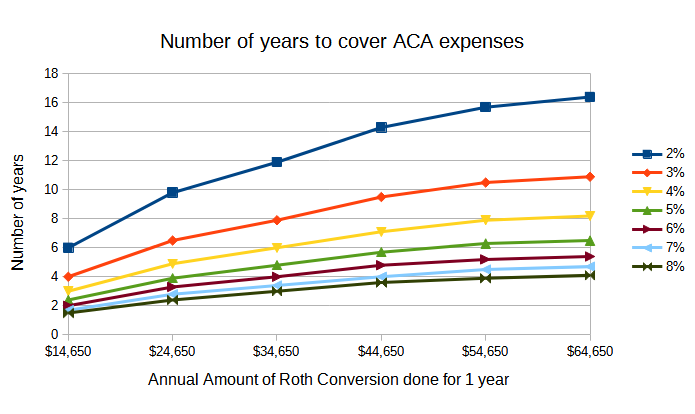

What we are looking for is the number of years required for income due to the Roth conversion to cover expenses incurred due to ACA cost and taxes paid on conversion. It would be simply the total annual expense correspondent to specific amount of money being converted divided by the annual return for the rate between 2% and 8%.

As we can see from the chart, someone would need to wait somewhere from 2 to 16 years to actually enjoy the advantage due to the Roth conversion, given sharp increase in ACA premiums and taxes with the income. Obviously higher return rate makes conversions more efficient. Based on these data, it is advisable to make Roth conversion as small as possible to keep ACA premium and tax low.

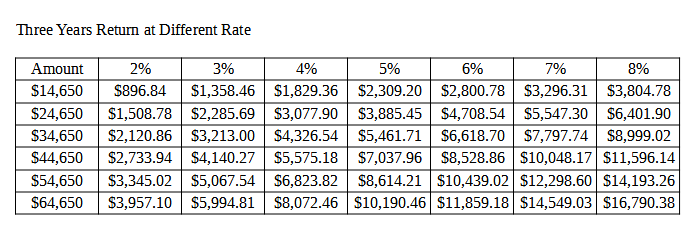

Does this mean Roth conversions are not desirable at all when ACA is in picture? Of course not. The return on Roth money will grow with years to come. In fact, it is better to check cumulative return after the few years, rather than the annual return. This is a table for three years cumulative return which means annual return is reinvested to generate more income in the next year.

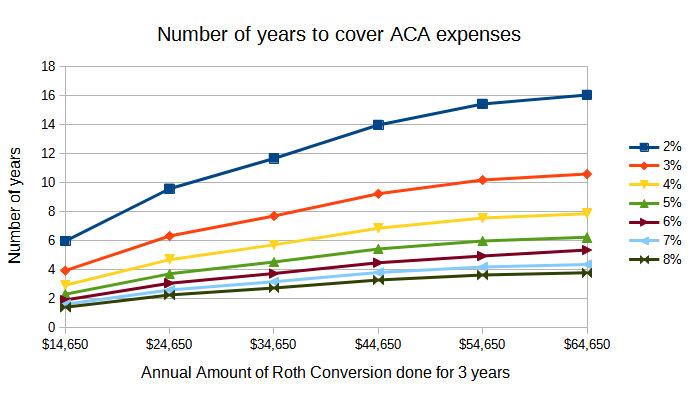

Once we put these data into the chart, it is clear that although the shape of the curves remain the same there is a small shift into the lower end. It will take up to 2 years to cover expenses incurred by $24,650 conversion with 8% return which does not look too long. But it is hard to achieve 8% annual return: in a real life it will be more likely in 4-5% range. Apparently more advantage will come for 4 or 5 years of cumulative return.

But would it be wise to leave income in Roth IRA, reinvest it rather than use immediately? This is actually the only option for people younger than 59.5 when the entire Roth distribution become tax and penalty free. By that reason, it makes more sense for early retirees to do Roth conversions as soon as possible to see more advantage in the future.