B. Franklin said: In this world, nothing can be said to be certain, except death and taxes. Paying tax is our duty, as responsible citizens. US definitely does not have the highest tax in a world. However, in contrast to other countries, it imposes tax on every citizen, no matter where he or she lives. As long as you are US citizen, you must submit a federal tax return. Along with US tax return, you are also required submitting a tax return in other country to comply with local laws, just in case if you prefer to live in other country for an extended time. Most countries require to submit a tax return, when someone is physically present in the country for at least 183 days in a year. Does it look scary? Actually, it can be managed. In this article, I wanted to focus on foreign tax specifics for US citizens living abroad.

First, I would like to discuss US tax. The tax form 1040 must be submitted, regardless where you live. The deadline for Americans living abroad is June 15th, but it still makes sense to submit a tax return by April 15th because of the interest charged if some tax is due. Taxes must be paid on the combined worldwide income. However, there are two methods, US citizen can use to reduce tax: FEIE (Foreign Earned Income Exclusion) and FTC (Foreign Tax Credit).

Any US citizen with a tax residence outside of US is qualified for FEIE. Even without foreign tax residence established, anyone who have been outside of US for 330 days during the tax year is also qualified for FEIE. The exclusion is applicable to the income received for performing services in other country, i.e. wages, salaries, tips, etc. Capital gains, dividends, rental income, pensions are not considered as earned income and no exclusion is allowed. In 2017, the exclusion limit is $102,100. This would mean, that no tax will be withheld on any earned income below this limit. However, if the amount is greater than $102,100 then the difference between the earned income and exclusion limit is taxable at the rate of the total income earned abroad. For example, no tax is required for the annual income $90,000. However, for the annual income $110,000 tax is due on $7,900 at the rate of $110,000. This would mean, that 28% tax on $7,900 (which is equal to $2,212) will be collected.

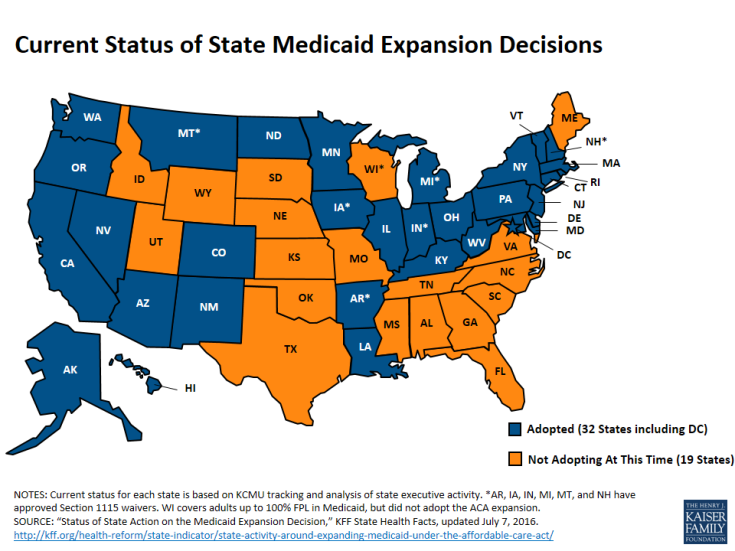

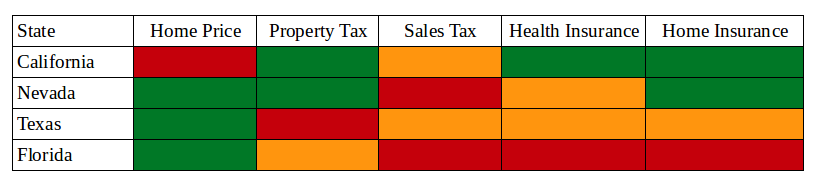

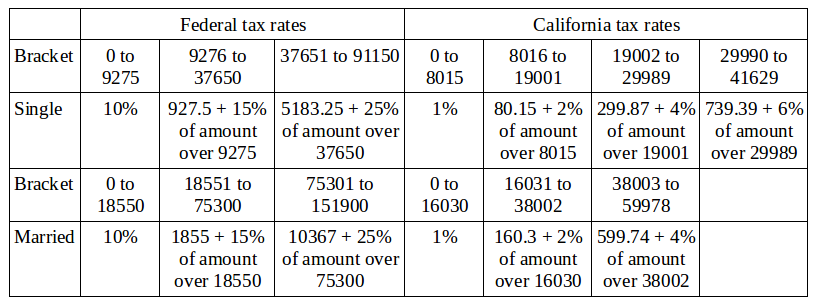

Typically, no state or local tax is due for those living abroad, as long as they do not have any property or income from the sources within the state. For example, if someone living abroad rent out his or her property, tax on the rental income along with the property tax must be paid. But rules and regulations are different across the states. Most states would release their former residents from tax obligation, as long as they live for more than 6 months outside the state. But some states makes it extremely difficult to end the residency, in particular: California, Virginia, South Carolina, New Mexico. In order to leave one of these states, former resident must prove that he or she has no intention to return to the state and there are no connections left. For example, in California you must file a non-resident tax return, as long as you are physically absent but still “domiciled” in the state. Under the “domicile” term, authorities consider the place where you intend to return. Your property, the place where spouse and children live, days spent inside the state, obtaining professional services, bank accounts, organizations membership, driver license, voter or vehicle registration are among the “domicile” considerations. By the reasons stated above, it is always advised to establish home address in one of the states which does not have income tax, before leaving US.

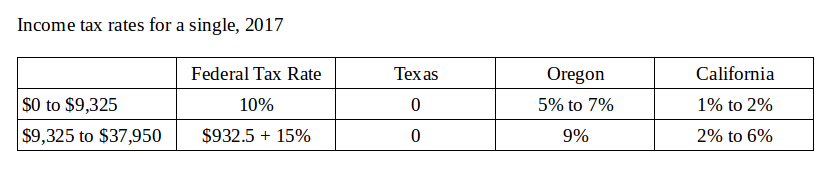

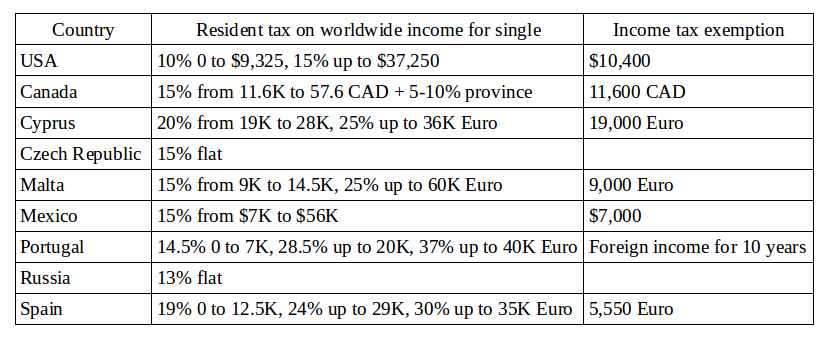

In order to avoid double taxation, US has tax treaties with more than 42 countries. FTC can be claimed for a tax paid to the foreign government, to reduce the amount of tax on worldwide income paid to US government. It is available to anyone, who have earned or investment income in a foreign country. For example, if tax is paid on investment property in foreign county, then this tax is exempt from US tax. But in case of retirement, the income typically comes from US sources. Does it mean, that the tax paid to US government is also due for a foreign government? It is normally not a case for those countries, which has tax treaty with US. For example, in Canada resident allowed claiming a foreign tax credit on Canadian return for any tax paid in US. After all, the total tax you pay while living abroad depends if the foreign country has tax higher than US or not. The final tax to be paid is typically the highest one, either in US or another country of residence. Also, some amount of small income may be exempt from tax. In the table below, you can see the tax on residents in certain countries.

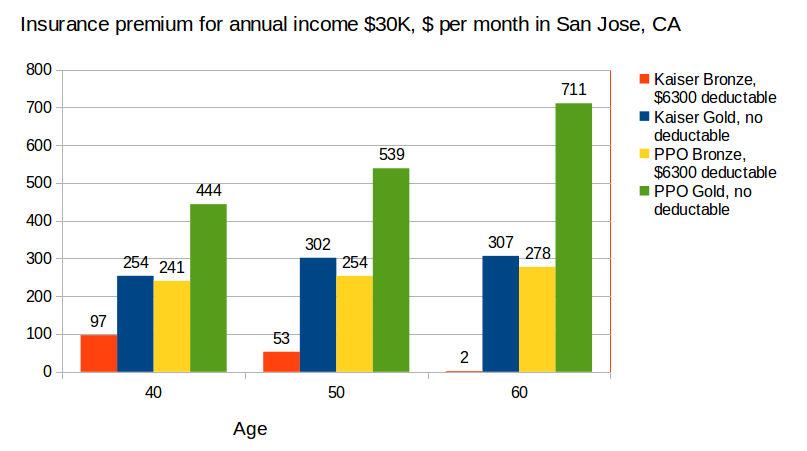

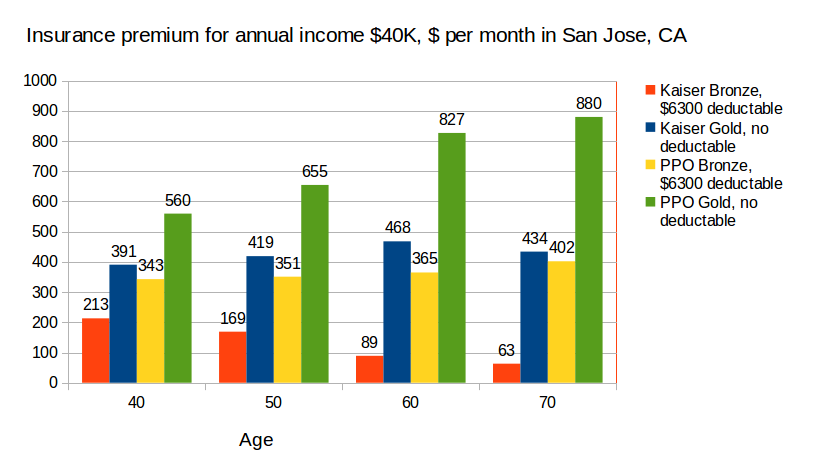

It is easy to see, which country has a tax higher than US for certain level of income. Some countries are quite popular with US retirees, others are not. The most generous exemption is offered by Portugal: foreign residents do not have to pay any tax on their foreign income during the first 10 years of residency. Cyprus offer 19K Euro exemption, which may be a deal for those with low income from US. But what about some Latin America countries, popular with US retirees like Costa Rica, Panama, Ecuador? All these governments actually share tax payers data with US government. However, residents in Costa Rica, Panama or Ecuador must pay tax on income generated in their respective countries only. This would mean, that a typical retiree is responsible for US federal tax, which is essentially the same as it would be when living in US in a state with no income tax. Also, another good news is that both Panama and Ecuador has dollar as their official currency and US citizens living there does not have to worry about exchange rates. Hate paying US federal tax? Then move to Puerto Rico: its residents are not required to pay US personal income tax.