Social security system in US provides you and your family with benefits, in case you retired, become disable or die. We will focus on retirement benefits here. It works like a federal fund. During our entire career, we contribute some amount of money into the fund as Social Security tax. If you have earned income then in a paycheck, it comes as a separate tax category. Currently the tax is 12.4%, and half of it is paid by employer. Self-employed are responsible for the entire tax. In year 2016, this tax is applied to the first $118,500 of annual earnings, which is Maximum Taxable Earnings. By that reason, if you happen to make more than $118,500 annually then the tax is still the same. Maximum Taxable Earnings are adjusted with inflation, for example in year 2000 it was $76,200. The money we contribute are managed by federal government (Department of Treasury), and invested in Treasury securities only. When retirement age comes, anyone who contributed into the system for at least 10 years can apply for the benefits. Money will be paid back. Most states does not impose tax on social security benefits, but some does: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia.

When you decide to apply for social security benefits, there are a couple of important points to remember. First, there is a full retirement age when we can apply for the benefit based on year of birth. Also, there is a minimum retirement age. I can apply at 62 and the full retirement age is 67. Second, the amount of benefit is increasing with age when we apply. It does not increase anymore if you apply after 70. The exact amount the person can receive when applied at particular age can be found at Social Security Administration site using online account. Also, there are multiple calculators available on the web for benefits estimation. I found that this excellent online calculator provide more insight than others. Actually it is even possible to estimate the amount of benefits when you stop working before the minimum retirement age. But unfortunately it does not provide the flexibility to simulate the situation when you stop working early but apply for the benefits later after 62. I tried more advanced detailed social security calculator but it required installation and its report is difficult to read. Also, there is a very good article written by Joe at retireby40 how early retirement affect benefits. But it did not address my specific need either. By that reason, I decided to learn more how benefits are exactly calculated and share the findings in this blog.

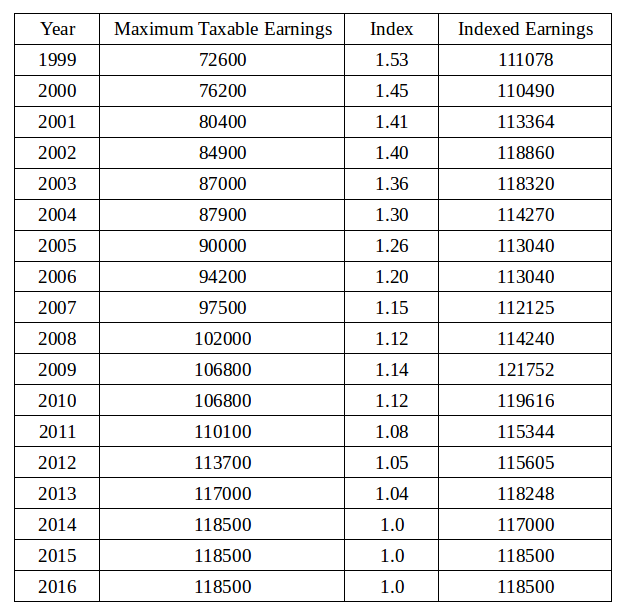

The social security benefits are calculated using an average of 35 years when the highest amount of money contributed into the system. Actually, you may not need the exact numbers if the earnings were greater than Maximum Taxable Earning defined for particular year. The earnings are indexed with year specific coefficient, defined according to the inflation. In other words, indexed earning are earnings in current dollars. inflation index for each year while at work provided at the document published by Social Security Administration. I combined the numbers into the table starting from 1999 (when I started career), and computed indexed earnings for each year.

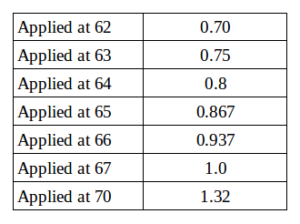

Using this table, I calculated the total number in the right column. I use Maximum Taxable Earnings, because my actual annual income was greater than that. If your annual income is less, then you need to substitute actual annual income for each year. The final number divided by 35 and by 12 provides average earnings over 35 years adjusted for current dollar. Obviously, I do not have 35 years career yet and missing years are represented as 0. For future years, I use the same index number and Maximum Taxable Earnings as for 2016. The benefit at full retirement age (which is 67 for me) is calculated using the average number as 90% of the first $856, combined with 32% between $856 and $5157 and finally combined with 15% of the remaining part. You can clearly see that higher earnings contribute less into the benefit. This will be the benefit at full age. I compared the number computed using this method with the results of online calculator and the difference is just a few dollars. I may be missing some details, but method is working correctly. What if you decided to apply earlier at 62 for example, or later? In this case, full benefit reduction (or gain) coefficients are applied. Coefficients currently in use are available for example at bankrate survey. I compiled a table with coefficients, which provide a clear picture how application delay affects the benefit.

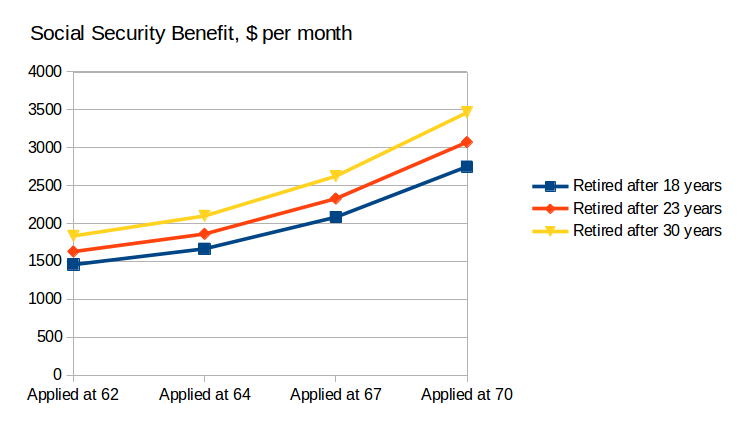

This is a very important table. Logically, you may assume that the benefit does not increase when you stop working and no contributions made to the system. But in fact the benefit increases in any case. It is designed to encourage people to delay their application. With all these data, I decided to figure out what would be the impact of early retirement combined with late application? Again, I use year 1999 as a reference and count 18, 23 and 30 years of career starting from that year. This graph clearly show that the time when I actually apply for benefit is much more important than the time when I stop working. Even if I apply at 70, the difference between terminating job after 18 and 30 years is around 30%. The difference between 18 and 30 years is less if I apply at 62. However, application at 62 and 70 yield a difference of almost 50% (if retired after 30 years). Please remember these numbers are calculated in assumption that index numbers, benefit reduction coefficients and Maximum Taxable Earnings stay the same for future years. But in reality they will increase with inflation sooner or later, and the final numbers will raise as well.

What conclusion would you draw? I believe the correct strategy is to delay application for benefits as long as possible, up to the age of 70. But collecting enough savings to live is even more important. It is not clear what will happen with social security in 20 years ahead. I am sure it will be around in some shape. But it may become private. Inflation coefficients may not grow as fast as in the past. Minimum retirement age can be increased. Or after all we may not live that long. This is why it is important to rely more on savings rather than the benefits, and decide on retirement solely based on your life style and spending counted against savings.