Retirement saving plans such as 401K or IRA are increasingly popular, because they allow contributing money before tax. Especially for those who are in high tax bracket. Also, some employers are matching a part of 401K contribution, which makes it even more attractive while we are at work. However, disappointment comes later at the age of 59.5 when it is a time to withdraw money. At that time, we have to pay tax. The greater amount we save, the greater tax will be. For those like me who live in a state with income tax, the state tax will be added. Is there a way to collect money completely tax free?

There is a great article written by MadFientist, who give some idea how to do that. The idea is to contribute into 401K or traditional IRA during the working years, but after retirement convert small portions of savings from 401K or traditional IRA into Roth IRA each year. The converted amount needs to be carefully calculated, to offset personal exemptions and deductions. In this way, conversion will be tax free. This is in assumption that you retire before the age of 59.5 and you can not withdraw money from 401K or traditional IRA directly without penalty. Money are available tax free from Roth IRA at the age of 59.5.

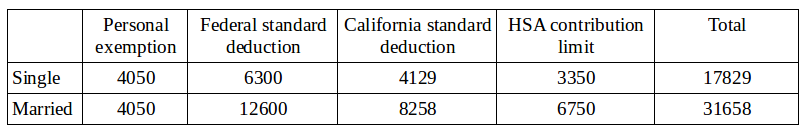

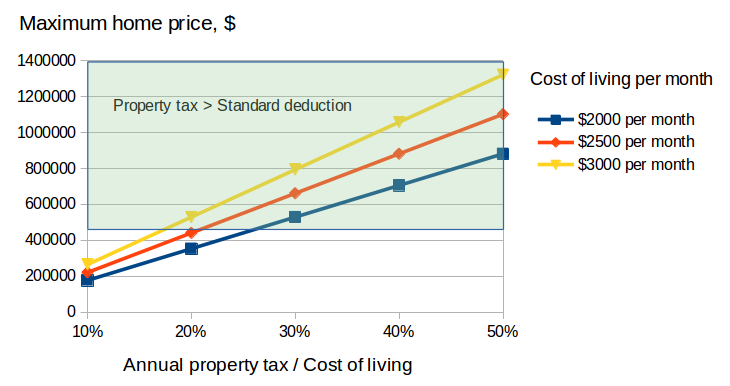

In a reality, this excellent idea works for married couples rather than singles. I combined all 2016 exemptions and deductions any person can always claim in a typical situation in the table. I assume the person lives in California: other states may have different numbers and some states does not have income tax at all. Also, I added Health Savings Account, which become more and more popular these days and can add up into deductions. It works pretty much in the same way as 401K or traditional IRA, but permits withdrawals for medical expenses.

Also, let us take a look at tax brackets, both federal and California. I intentionally included three lowest brackets only, because I assume most people with limited lifetime savings will most likely fall into 10% or 15% federal brackets after the retirement.

How to collect money from 401K tax free? The idea discussed by MadFientist is to deduct certain amount of money from the total income before tax, and take the same amount of money out of 401K or traditional IRA into Roth IRA. For example, combined personal exemption $4,050 and standard deduction for married couple $12,600 deducted from the income can be replaced with $16,650 collected from 401K plan. As a result, the taxable income and tax will not change because of 401K money transfer. In other words, $16,650 comes with no tax. Obviously, there may be other income which can not be deducted and the tax must be paid for that income. But the good news is that no federal tax will be withheld from long term capital gain in federal tax bracket 10% or 15%. By replacing ordinary income with long term capital gain, it is possible to avoid federal taxes completely. Some states do not have income tax, but others like California does. However, California tax rates are much lower than federal rates. There are other types of investment such as California issued municipal bonds, which are exempt from both federal and state tax.

The deductions for married couple are twice as large as for single and tax brackets are also doubled. As pointed out in another great article by Curry Cracker, married couple can deduct up to $19,500 from income (which comes to $23,400 for those who file tax return for year 2016 and contribute into HSA). What does it mean? It means that anyone who is married can offset $23,400 income by annual withdrawal of the same amount from 401K or traditional IRA into Roth IRA. For example if someone has $250K in 401K plan, then it would require 10 and half years to collect all money from 401K without paying tax. Which is probably a reasonable time, even for those retired after 50. However, if we take a closer look at deductions for single person, then we have $13,700 only to deduct. For the same amount of savings, it would require almost 20 years to withdraw all money. It is a long time. Moreover, we need to reduce $13,700 by annual taxable income (I assume it still exists in some form), which raises withdrawal time to 25-30 years. Not every person live that long after retirement.

There is actually a way to attack this problem for single people. But single person must be a homeowner. Because property tax is the important deduction, which may have substantial impact to overall numbers. The property taxes in US for single family homes vary from $3K to $20K in most cases. It depends on home size and area. In areas with high cost of real estate, property tax can be higher than federal or state standard deduction. For example, I pay around $12K property tax annually and obviously use itemized deductions to reduce taxable income. It helps to offset taxable income when you have high wages, but may have opposite effect once you retire. Suddenly you realize that your income is so small that this deduction does not make sense anymore. But actually it does, when you want to withdraw money from 401K tax free. Property tax must be paid anyway, because we need a place to live. Let us use it for our own favor.

This approach works better when property tax is high, and its effectiveness degrade with amount of tax approaching standard deduction which is $6,300 for single. For California, you will end up paying more than that because of the high home prices (property tax is relatively low), but in Texas it is also achievable because of the high property tax up to 5% in some counties. But the real question is: can you afford this house during retirement? People tend to move to lower cost areas and live in cheap apartment, when amount of savings is limited. Can you afford the house with property tax high enough to offset income tax? It is easy to estimate, using 4% rule. The rule definition can be found for example here. The rule say that in a retirement, we can safely withdraw 4% of the total assets to make sure some money will be still available until the end of life.

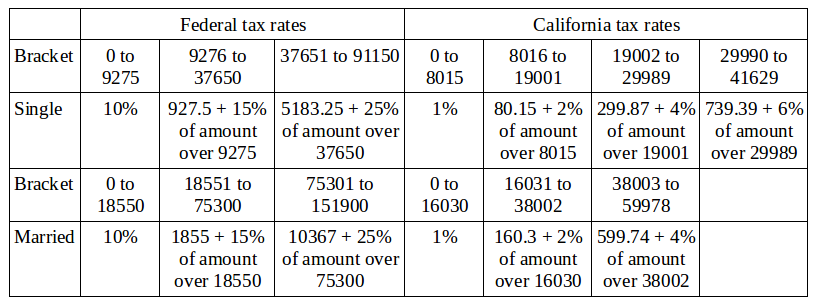

The maximum home price and associated property tax depends on two factors: total amount of assets available and projected cost of living. I am single and I can not see myself spending more than $3K per month, unless some emergency happens. I can probably live on $2.5K, by taking special care about daily expenses. It would be a challenge to survive with $2K per month at expensive place such as San Francisco Bay Area, but someone else living in Texas for example most likely can live on $2K. Therefore, I prepared a chart about the impact of property tax and cost of living on the maximum home price retired person can afford. I use the ratio of annual property tax to cost of living from 10% to 50%, as I do not believe it is reasonable to spend more than 50% on property tax. I used Santa Clara county property tax rate 1.36% to calculate the home price. 401K conversion tax can be offset by property tax within a green area: homes priced above $463K are well within the range for many metro areas now. At least 20% to 30% of annual expenses are required to spend on property tax in order to collect tax free money from 401K plan, which seems reasonable to me.

You can determine where you are in this chart with the help of 4% rule, using the total amount of assets you have as follows: [home price] = [total asset] – [cost of living] x 12 / 0.04. Then you can see if you are within the green area or not, and determine the optimal property tax to cost of living ratio to eliminate tax. For example, with $1M in assets and cost of living $2500 per month the home price would be: $1M – $2500 x 12 / 0.04 = $250K and the goal can not be achieved. However, with $1.5M in assets and cost of living $3000 per month the maximum home price would be $750K. It means that you can buy a home within $463K to $750K price range and achieve the goal by spending 20% to 30% of annual expenses on property tax. But most likely property tax is higher than 1.36% in a county where you live. In this case, the lower bound for home price to achieve tax free 401K goal will come down to $252K for property tax 2.5% and it can be as low as $126K for property tax 5%.

Finally, a few words about Health Savings Account (HSA). It definitely can help to offset 401K tax, when included into deductions. It is not required to have earned income to contribute into HSA, therefore it can be done even during retirement. After the age of 55 the contribution limit increases by $1000, which makes it even more attractive for tax purpose. But the advantages of each individual plan compared with ordinary health care plans must be carefully reviewed for an educated choice. The advantage of HSA can be combined with the advantage of some 401K plans, which allow withdrawing money without penalty if employee left job at the age of 55 or later. Then the most effective strategy can be, assuming enough financial assets are available at the time of termination:

- quit your job at the age of 55

- contribute into HSA and withdraw money tax free and penalty free from 401K directly to personal account between the age of 55 and 65

- withdraw money whatever left on HSA tax free and penalty free between the age of 65 and 70

- apply for social security benefits at the age of 70

It’s very easy to find out any topic on net as compared to books, as I found this

paragraph at this site.

Hi there! Quick question that’s entirely off

topic. Do you know how to make your site mobile friendly?

My website looks weird when browsing from my apple iphone.

I’m trying to find a theme or plugin that might be able to resolve this issue.

If you have any suggestions, please share. Thank you!

Hi, actually this is great question. I do not have an answer right now but I will research this matter. Most likely some changes are required from my side.

Thanks for sharing your thoughts on slot gacor hari ini.

Regards

Thanks a lot.

It’s actually a cool and useful piece of information. I’m glad that

you just shared this useful information with us.

Please stay us up to date like this. Thank you for sharing.

Thanks for the great comment. Yes I know I need to publish here more frequently and I will focus on it.

Hello I am so excited I found your weblog, I really found

you by mistake, while I was browsing on Askjeeve for something else, Anyways I am

here now and would just like to say thank you for a incredible post and a all round entertaining blog (I also love the theme/design), I don’t have time to go through it

all at the minute but I have book-marked it and

also added your RSS feeds, so when I have time I will be back to read much more, Please

do keep up the fantastic jo.

Thank you so much for the comment. I will try to publish more going forward.

Thanks very interesting blog!

What i don’t understood is if truth be told how you are not really

a lot more well-liked than you might be now. You are so intelligent.

You understand therefore considerably in relation to this topic, produced me individually believe it from a

lot of numerous angles. Its like men and women don’t

seem to be interested until it’s one thing to accomplish with Lady gaga!

Your own stuffs great. All the time care for it up!

Feel free to visit my page: “http://xn--2z2bv8nb8c6uns0gezb.com/bbs/board.php?bo_table=free&wr_id=19767

Heya this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if

you have to manually code with HTML. I’m starting a blog soon but have

no coding experience so I wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

When some one searches for his necessary thing, therefore he/she wants to be available that in detail, thus that thing is maintained over here.

Howdy! This post could not be written any better!

Looking at this post reminds me of my previous roommate! He continually kept talking

about this. I will forward this information to him. Fairly certain he will have a great read.

I appreciate you for sharing!

My page – “https://www.abcchemcleaners.com/2015/03/early-season-carpet-cleaning-special/

Greetings from California! I’m bored at work so I decided to browse your blog on my iphone during lunch break.

I enjoy the info you present here and can’t wait to take a look

when I get home. I’m amazed at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyhow, amazing blog!

I used to be able to find good advice from your content.

Hmm is anyone else experiencing problems with the images on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

Amazing! This blog looks just like my old one!

It’s on a totally different subject but it has pretty much the same layout and design. Great choice of colors!

This blog was… how do I say it? Relevant!! Finally I’ve found something that helped me. Cheers!

This is a topic which is near to my heart… Many thanks!

Where are your contact details though?

Way cool! Some extremely valid points! I appreciate you writing this write-up and the rest of the site is also very good.

I am curious to find out what blog platform you have been using?

I’m having some minor security issues with my latest site and I would like

to find something more risk-free. Do you have any solutions?