Retirement may be a dream time for many people, but it comes with a challenge. Everyone still need a regular paycheck, to cover living expenses. But there is no employer anymore, who take care about it. It is better to plan for retirement income well in advance. Is it possible at all, in ever-changing world where we live? In this article, I would like to discuss buckets approach which actually can help the average retiree.

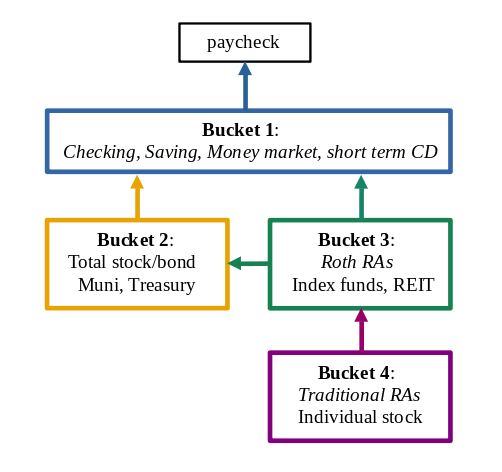

The buckets approach has been discussed lately in various forms, from two to eight buckets. The basic idea has been presented for example here. In order to sustain and even grow money in rapidly evolving market conditions, there is a need to split the entire amount of money saved for retirement into a few sources or buckets. The goal is to make sure a volatile stock price would not have a direct impact to the quality of life, and at the same time investments continue to grow and provide a reasonable return.

How much money does each bucket hold? It depends on two major factors: the amount of planned living expenses, and the worst case market recovery time. While the cost of living during retirement is different for every person, the market recovery time can be estimated from the chart below. This is a historic chart providing a composite S&P 500 index valuation over many decades. Typically, the market recovery takes a few years but sometimes it may take as long as 10 years or even longer. Therefore, in order to avoid losses it would be reasonable to assume that the most risky assets must be held well beyond 10 years.

The Bucket 1 is essentially the one which provide a regular income during the retirement years. It may include sources such as regular checking or saving account, money market account and short term CD. Money are FDIC insured and does not depend on market fluctuations. How much money do we need in this bucket? Typically, these funds need to cover 2-3 years of living expenses. For someone ultra conservative, 5 years of living expenses would be even better choice. For example, if someone’s plan is to spend $25K each year the bucket need to carry $75K to $100K. But if someone would like to withdraw $40K each year then the bucket funds would increase to $200K.

The Bucket 2 contain assets which does not require immediate access (Bucket 1 is designed for that), but still expected to hold its value well during 8-10 years between the recessions which is equivalent to $300K to $400K. It may include longer term CDs, Treasury Notes, Municipal funds or even total market stock or bond funds. While there is a risk involved, the value is expected to be relatively stable. These are after tax assets i.e. it is assumed the tax has been already paid on principal amount of money. Money in this bucket can be used to fund Bucket 1, when required.

The Bucket 3 and Bucket 4 are intended for long term investments, which are expected to grow over the retirement time. These are primarily retirement accounts (RA) which involve some tax breaks as well as additional tax burden. Bucket 3 include money in Roth accounts, which grow tax-free and can be withdrawn by anyone older than 59.5 without penalty. It makes sense to hold low cost index funds there, as well as individual REIT because of the complex taxation laws around them. Also it may be beneficial to include more risky assets into Bucket 3. Money from this bucket can be used to fund Bucket 2 or directly Bucket 1, whenever there is a need.

The Bucket 4 holds money in traditional retirement accounts such as tIRA or 401K. These are pretax money i.e. any distribution would trigger an ordinary interest tax. These funds need to be slowly converted into Roth (early Roth conversions were explained in details here), in order to avoid high tax bracket and eventually Required Minimum Distribution (RMD). Roth’s conversions can be started any time, without implications other than tax imposed on distributions. Since these funds are not supposed to be used for a very long time, the most risky assets like individual stocks can be purchased here.

All buckets and fund transfer directions between them are presented in the figure below.

Finally, a few words about the real estate. It does not make sense to include a primary home here: it is hard to consider as a source of income. However, rental income can be included into Bucket 1 as funds directly accessible to cover expenses. The rental or second home sale can also be considered as potential income which would be reasonable to include into Bucket 4, because of the tax due on this sale.