Roth’s account is a great retirement asset, designed for our money to grow tax-free and penalty free. Indeed, there are no tax or fees on Roth distributions for those over 59.5 years old. Moreover, there are no required distributions at certain age like other retirement accounts has. It is attractive to keep retirement savings there. But there are limited options available to fund Roth IRA, and pretty much all of them involve a tax bill. We will discuss today how to lower or possibly avoid this tax all together.

First let us figure out how to contribute into Roth IRA:

- any individual can directly contribute up to $6K ($7K for those over 50) annually if MAGI (Modified Adjusted Gross Income) is less than $124K (single) or $196K (married) as of 2020

- rollover contributions (conversion from traditional IRA or 401K to Roth IRA) are available to individuals with any income and there is no annual limit

As you can see, there is still a way to contribute a significant amount of money into Roth IRA through a rollover. However the same annual contribution limits are applied to traditional IRA and it is hard to accumulate substantial money there. Still, Backdoor Roth is an opportunity for everyone with high income to establish Roth IRA and contribute into it: initially after tax money are contributed into traditional IRA account and then immediately converted into Roth IRA, to avoid any tax implications.

Other opportunities allow in fact to contribute unlimited amount of money into Roth IRA:

- Former employer’s 401K rollover into Roth IRA: available to those who change employer during their career, which is the case for most people in US

- Mega backdoor Roth: after tax 401K rollover into Roth IRA, if permitted by employer

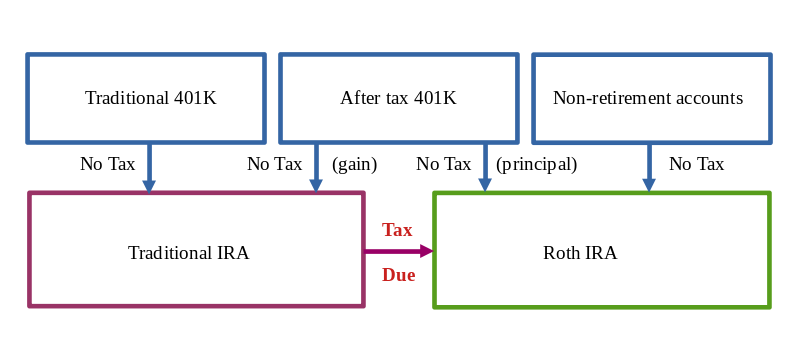

The first option is available to anyone who left an employer which made 401K plan available to employees. We consider traditional 401K here, because Roth 401K is still rare to find. There is no annual limit on such a rollover. However, there is a tax due for the entire amount converted during the year of rollover. This is because 401K funded with money contributed before tax has been withheld. It is a two steps process: initially 401K money are converted into traditional IRA and no tax withheld, then money from traditional IRA converted into Roth IRA and ordinary income tax is due.

The second option is available with selective employers, which provide an opportunity to contribute into after tax 401K. These are after tax money subject to $63,500 annual limit (for all 401K contributions combined), and can be converted directly into Roth IRA (principal) and into traditional IRA (capital gain). Moreover, the conversion may sometimes take place for an active employee (in-service rollover). It important to mention that there is no tax due for this conversion.

Whatever option has been used, the tricky part is a conversion of pretax money accumulated in traditional IRA into the Roth IRA as both federal and state tax is due with this conversion regardless on age or other conditions. Obviously, the amount of tax depend on individual’s tax bracket in year of conversion. It may be hard to control it while being employed, especially with high compensation job. By that reason, most people postpone conversion till they retire in lower tax bracket. While in general it seems a right strategy, the following considerations are important:

- Modified Adjust Gross Income (MAGI) is important not just to reduce the Roth conversion tax bill, but also to qualify for health care subsidies under ACA

- Medicare premiums required for those over 65 years old also depend on MAGI

- While Social Security benefits itself may not be taxable in most states, there will be a tax if it is combined with Roth conversions

- Ability to postpone Social Security benefit application till 70 may temporarily reduce the tax bill but increase it later

- Required Minimum Distribution (RMD) from pretax retirement accounts such as traditional IRA and/or 401K triggered for those 72 years old would make tax even higher

Therefore, the main question is when to start and complete Roth conversions, in order to minimize the overall tax burden? There is no simple answer to this question. It depends on many factors, including individual assets and the time of retirement. But there are simple rules which allow evaluating different strategies and come up with the best one.

MAGI is essentially a taxable income, combined with certain deductions such as Social Security benefit, individual retirement contribution and tax-exempt interest. In 2020, all individuals with MAGI between $12,490 and $49,960 or households with MAGI from $21,330 and $85,320 qualify for tax credits to lower health care premium under ACA (also known as Obamacare act). People with income lower than $12,490 are covered under Medicaid expansion available in most states. Tax credits are the highest for those with the lowest income and gradually phased out for higher income individuals or households.

Medicare premiums are also based on MAGI. Everyone is eligible for Medicare starting at 65. Standard Medicare Plan B rate (which is $144.6 a month in 2020) is available for individuals with income less than $87K and for married couples with income less than $174K. At higher income, premiums rise up to $491.60.

Social security benefits are exempt from federal tax (and from state tax in most states). However, individuals with total income greater than $25K and couples with total income greater than $32K must pay tax on social security benefit. Up to 50% of the benefit is taxed for those with annual income between $25K and $34K ($32K to $44K for couples) and up to 85% is taxed for those with income greater than the limits above. Again, MAGI is considered as a total income for this purpose.

Required Minimum Distribution (RMD) is applied to those older than 72, and with pretax money left in retirement accounts such as traditional IRA or 401K. For a tax purpose, the ordinary income tax is due on entire amount of assets converted during a tax year. The annual amount of RMD is determined as remaining eligible account balance at the end of previous tax year divided by Life Expectancy Factor. The factor is uniform and depend on age: it start with 25.6 for those 72 years old, and gradually reduced to 10.2 for those 92 years old and further down to 1.9 for 115 years old.

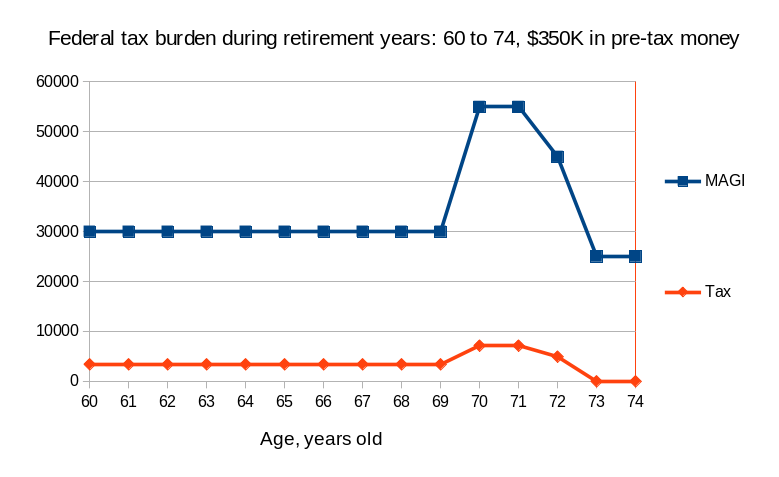

Let us consider an example of individual who accumulated $350K in traditional IRA and looking forward for annual Social Security benefit of $25K taken at 70. He/she has a plan to retire at 60, and do regular Roth conversions year after year until 72 with a goal to convert everything before RMD kick in. Then ideally MAGI and income tax would look like in the chart below.

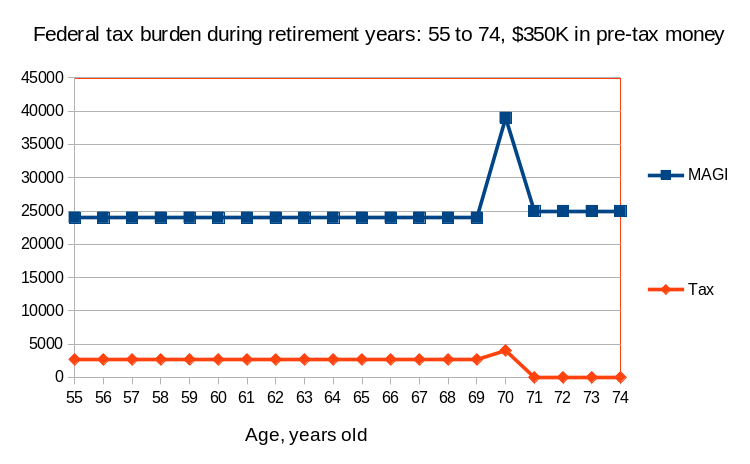

The spike after the age of 69 is due to Social Security tax applied during the Roth conversions. Apparently there will be no impact on Medicare premium and tax will reset to zero once all conversions are done. But what if this individual decides to retire at 55 years old, rather than 60? The chart become a little different.

Obviously the tax bracket changed from 22% to 12% and the spike is much lower than in previous case. But what about the total tax paid during the observation time? Surprisingly, the difference is not that much: $46,128 in the first case which is 60 to 74, compared to $44,326 in the second case which is 55 to 74. Does it make sense to do such a detailed planning to save so little? Actually it does.

The difference comes from ACA subsidies, which can be estimated using this great calculator. For MAGI $30K in the first case, annual premium cap for individual is $2511 and for MAGI $24K (second case) it is dropped to $1586. This is another $1K of savings. For a couple, the difference is less impressive: $1799 compared to $1012. But this is an ideal case. To make it realistic, the following numbers need to be adjusted:

- We assumed there is $350K saved in pretax money. But for those retired at 60 this amount would likely increase compared to those retired at 55, which means additional tax. Also, many people have accumulated more than $350K in pretax money even at the age of 55.

- Social security benefit taken at 70 may not be $25K as assumed here. It can be less or greater, depend on the number of contribution years and compensation level.

- It is a rare case when MAGI is exactly equal to Roth conversion each year. There might be an additional income and deductions taken. It is easier to drive tax down to almost zero in the second case through the deductions, by investing into tax exempt funds for example.

- Health care premiums can also be driven to near zero, when retiree younger than 65 qualify for Medicaid with MAGI below 138% of Federal Poverty Level ($17,609 for individual and $23,791 for a couple in 2020).

- Roth’s conversions can be spread beyond the age of 72, but careful RMD evaluation is required in this case.

According to the statistics, most people choose to retire at 65 or later. In this case, opportunity to reduce tax with Roth conversion is limited and high tax bracket is almost guaranteed through the rest of the life.

Every weekend i used to go to see this web page, because i wish for enjoyment, since this

this website conations in fact nice funny information too.

Thanks very nice blog!

It’s a shame you don’t have a donate button! I’d definitely donate to this outstanding blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will share this site with my Facebook group. Talk soon!

Thank you. I intentionally keep it with no ads, no donation. I want to keep it free and clear for people interested in this topic.

Good article. I am experiencing many of these issues as well..

Thanks , I have recently been looking for information approximately this topic for a long time and yours is the best I have came upon till now.

But, what concerning the conclusion? Are you

certain about the source?

I used to be able to find good info from your articles.

I just like the valuable information you supply to your articles.

I will bookmark your weblog and test once

more right here frequently. I am reasonably certain I’ll be informed many

new stuff proper right here! Good luck for the next!

Fine way of telling, and fastidious paragraph to take information concerning my presentation topic, which i am going to present in college.