Everyone must pay tax. Nothing is certain but death and taxes. US citizens must always pay federal tax, no matter where they live. Tax return may get really complicated for those living abroad, because other countries require residents to pay tax on their worldwide income too. How to handle this situation correctly? We already discussed how to prepare for long stay abroad. In this article, I wanted to focus on situation when US citizen live outside of country with all income coming from US. It is typical for retirees and possibly some other people who do not have any source of income outside of US, but by another reason decided to live in a foreign country.

Typically, anyone must stay in the foreign country for more than 180 days in a single year to be considered as a tax payer. Therefore, permanent residence permit is likely required, unless expat share a dual citizenship between US and that country. Also it is important to mention that countries in the world are not created equal. They apply different laws and rules for tax regulation:

- Expat friendly countries with no local tax for people with US income only (most Latin America countries, for example) or no income tax at all

- countries which require all residents to pay a local tax but has a tax treaty with US to avoid double taxation (currently more than 60 countries)

- all other countries

If someone is lucky to live in the country like Mexico, then tax report does not look much different from the one filed within US. Federal US income tax is due on all income sources, and no local tax imposed for people with major income sources in US and no professional activities in Mexico. Even better, there is no need to report US state tax in this case unless rental property income is received. In a later case, tax implications depend on the state where property is located. Some states like Florida, Nevada or Washington does not have a state tax. There are also 10 countries position themselves as zero income tax heaven: United Arab Emirates, Oman, Bahrain, Qatar, Saudi Arabia, Kuwait, Bermuda, Cayman Islands, The Bahamas, Brunei. Of course these countries generate income from other sources, such as natural resources or extremely high living cost.

It is absolutely not in expat’s interest to live in the country which does not have a tax treaty with US. However tax rules may be regulated by country’s specific laws. Anyway, it is not a subject of our current discussion.

Situation is different for those who live in one of the countries which has a tax treaty with US. Overall, the highest tax between US and the country of residence is due in this case. In Europe, local tax is likely higher than US tax in most cases. Portugal is a nice exception, providing up to ten years of local tax break for expats living there. Living in the country with flat income tax can be an advantage when certain conditions met. Typically, it makes sense to pay US tax first and then submit a country’s specific form to local authorities to pay the rest to ensure no double taxation happened.

In order to estimate the total tax burden, we need to understand current brackets for US federal tax (ordinary income):

- 10% for income up to $9,875 (single) or $19,750 (couple)

- 12% for income up to $40,125 (single) or $80,250 (couple)

- 22% for income up to $85,525 (single) or $171,050 (couple)

- 24% for income up to $163,300 (single) or $326,600 (couple)

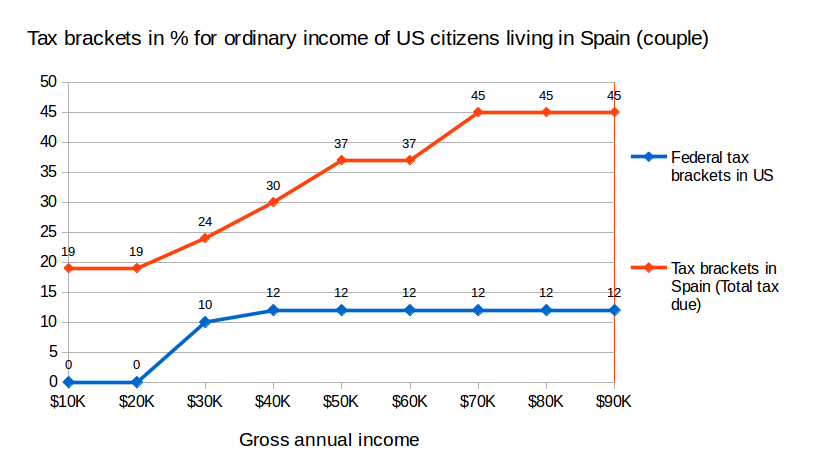

There is also a standard deduction $12K (single) or $24K (couple) available as a result of Tax Cuts and Jobs Act (2018). Let us compare US tax rate to another country with progressive tax rate similar to what we have in US, Spain for example. These are the individual tax brackets converted to US dollars:

- 19% for income up to $13,966

- 24% for income up to $22,660

- 30% for income up to $39,487

- 37% for income up to $67,308

- 45% for income above $67,308

In addition to that, some regional tax rates applied. There is a married couple allowance of $3,814, in addition to $6,226 general allowance granted to the first tax payer. But these allowances can be applied to Spanish tax only. Moreover, standard or any other type of deductions we normally take in US (including multiple rental property deductions) are not applicable either. Tax exempt bond yield needs to be reported as well: it is exempt in US but must be included into the taxable income for a foreign country. Below is a graph to study the total tax paid by US citizen living in Spain with the ordinary income from US sources in range of $10K to $90K annually.

Apparently, the total tax for those live in Spain is substantially higher than in US for the income range provided. Eventually US and Spanish tax rate would get closer for high earners. But the gap will be still there. It looks like there is just one way to minimize the total tax in this case: accumulate more money in retirement accounts. Within these accounts, capital gain or ordinary income is usually not a part of any tax return except for the specific tax events triggered by pretax to after tax money transactions.

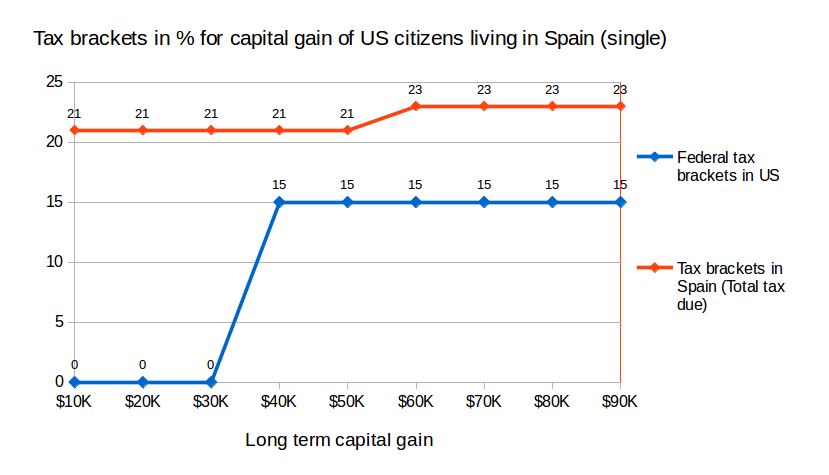

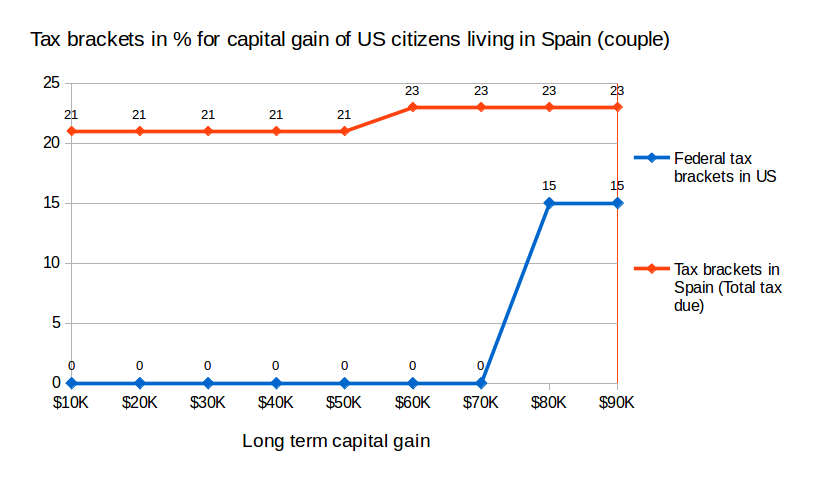

Similar situation observed for capital gain tax (please see the chart below). But the gap between Spanish and US tax become smaller and the curve for Spanish tax is almost flat now. Also the difference between red and blue curves diminish for single person earning more than $40K per year. Therefore, long term capital gain income (such as generated by the sale of stock held for more than one year) is definitely another way to reduce the total tax burden.

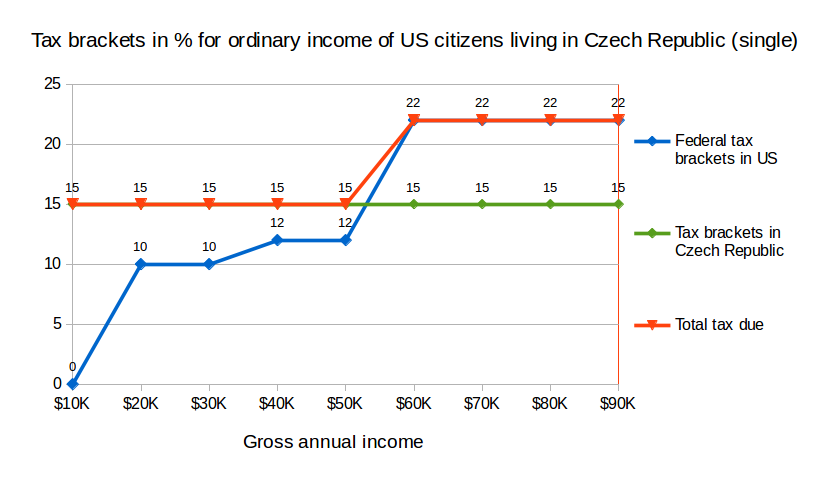

In fact, there is a flat income tax rate in some countries. It presents an interesting opportunity for expat who choose to live in one of these countries. Below is a chart to demonstrate a flat rate situation using Czech Republic with a tax rate of 15% for low to mid-income tax payers as an example.

Intersection of blue and green curves (around $53K) is a breaking point. On the right-hand side, total tax is limited by US tax (excluding deductions), while on the left-hand side total tax is limited by foreign tax (Czech in this case). Apparently, foreign tax has been effectively eliminated for those earning more than $53K due to the treaty with US. For expats living on a passive income from US sources, it may be wise to adjust the income to breaking point in order to simplify their tax returns and legally pay US tax only. As we already discussed in other article, taxable income can be adjusted with excessive Roth conversions of pretax money.

But the real advantage of flat tax rate would come to those who actually earn money from the foreign source either through employment or as a business owner. In this case, FEIE (Foreign Earned Income Exclusion) IRS provision allow deducting up to $105,900 of ordinary income earned from the foreign sources. This would mean a substantial US tax reduction and obviously the total tax reduction for residents of countries with a flat tax rate. In this case, greater earned income brings higher tax advantage.

The advantage also depends on what is actually a tax rate in a country of residence. While flat rates from 10% to 15% (Mongolia, Romania, Belarus, Russia, Bulgaria, Bolivia, etc.) can be attractive for most ordinary taxpayers, other countries with the rate in range of 15 – 25% (such as Belize, Estonia, Madagascar) may be a better fit for people with higher net worth and more substantial income. Overall, expat tax reporting process can be extremely complicated. In order to reduce a total tax burden, multiple sources recommend to look for assistance of tax professionals familiar with double taxation as well as with specific country’s rules and regulations.